American Airlines 2002 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

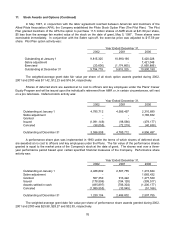

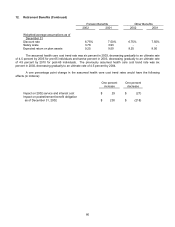

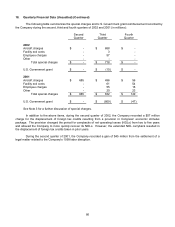

18. Quarterly Financial Data (Unaudited) (Continued)

The following table summarizes the special charges and U.S. Government grant reimbursement recorded by

the Company during the second, third and fourth quarters of 2002 and 2001 (in millions):

Second

Quarter

Third

Quarter

Fourth

Quarter

2002

Aircraft charges $ - $ 658 $ -

Facility exit costs - 3 -

Employee charges - 57 -

Other - - -

Total special charges $ - $ 718 $ -

U.S. Government grant $ - $ (10) $ -

2001

Aircraft charges $ 685 $ 496 $ 56

Facility exit costs - 61 54

Employee charges - 55 16

Other - 20 23

Total special charges $ 685 $ 632 $ 149

U.S. Government grant $ - $ (809) $ (47)

See Note 3 for a further discussion of special charges.

In addition to the above items, during the second quarter of 2002, the Company recorded a $57 million

charge for the displacement of foreign tax credits resulting from a provision in Congress’ economic stimulus

package. The provision changed the period for carrybacks of net operating losses (NOLs) from two to five years

and allowed the Company to more quickly recover its NOLs. However, the extended NOL carryback resulted in

the displacement of foreign tax credits taken in prior years.

During the second quarter of 2001, the Company recorded a gain of $45 million from the settlement of a

legal matter related to the Company’s 1999 labor disruption.