American Airlines 2002 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

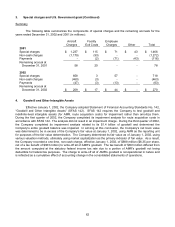

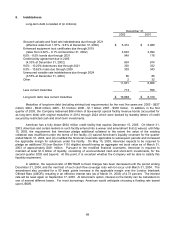

8. Indebtedness

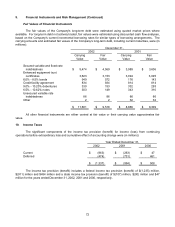

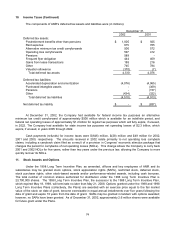

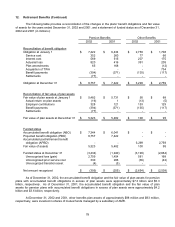

Long-term debt consisted of (in millions):

December 31,

2002 2001

Secured variable and fixed rate indebtedness due through 2021

(effective rates from 1.97% - 9.6% at December 31, 2002) $ 5,474 $ 3,989

Enhanced equipment trust certificates due through 2019

(rates from 2.02% - 9.1% at December 31, 2002) 3,623 3,094

6.0% - 8.5% bonds due through 2031 949 176

Credit facility agreement due in 2005

(4.33% at December 31, 2002) 834 814

9.0% - 10.20% debentures due through 2021 330 332

6.5% - 10.62% notes due through 2039 303 343

Unsecured variable rate indebtedness due through 2024

(3.55% at December 31, 2002) 86 86

Other 232

11,601 8,866

Less current maturities 713 556

Long-term debt, less current maturities $ 10,888 $ 8,310

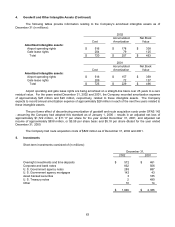

Maturities of long-term debt (including sinking fund requirements) for the next five years are: 2003 - $627

million; 2004 - $540 million; 2005 - $1.3 billion; 2006 - $1.1 billion; 2007 - $978 million. In addition, in the first

quarter of 2003, the Company redeemed $86 million of tax-exempt special facility revenue bonds (accounted for

as long-term debt) with original maturities in 2014 through 2024 which were backed by standby letters of credit

secured by restricted cash and short-term investments.

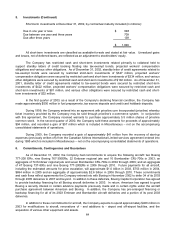

American has a fully drawn $834 million credit facility that expires December 15, 2005. On March 31,

2003, American and certain lenders in such facility entered into a waiver and amendment that (i) waived, until May

15, 2003, the requirement that American pledge additional collateral to the extent the value of the existing

collateral was insufficient under the terms of the facility, (ii) waived American’s liquidity covenant for the quarter

ended March 31, 2003, and (iii) modified the financial covenants applicable to subsequent periods and increased

the applicable margin for advances under the facility. On May 15, 2003, American expects to be required to

pledge an additional 30 (non-Section 1110 eligible) aircraft having an aggregate net book value as of March 31,

2003 of approximately $451 million. Pursuant to the modified financial covenants, American is required to

maintain at least $1.0 billion of liquidity, consisting of unencumbered cash and short-term investments, for the

second quarter 2003 and beyond. At this point, it is uncertain whether the Company will be able to satisfy this

liquidity requirement.

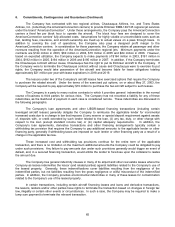

In addition, the required ratio of EBITDAR to fixed charges has been decreased until the period ending

December 31, 2004, and the next test of such cash flow coverage ratio will not occur until March 31, 2004. The

amendment also provided for a 50 basis points increase in the applicable margin over the London Interbank

Offered Rate (LIBOR), resulting in an effective interest rate (as of March 31, 2003) of 4.73 percent. The interest

rate will be reset again on September 17, 2003. At American's option, interest on the facility can be calculated on

one of several different bases. For most borrowings, American would anticipate choosing a floating rate based

upon LIBOR.