American Airlines 2002 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

The non-union employees formerly with TWA LLC have largely been integrated into the Company's work

force. The integration of unionized employees from TWA LLC who had to be integrated into unionized groups at

American has been more complex. The Company first engaged facilitators to work with American's and TWA

LLC's unions in attempting to reach integration agreements acceptable to all unions from both carriers.

Unfortunately, those discussions were unable to produce agreements acceptable to the relevant unions at both

carriers. American thereafter had separate discussions with the unions at American. It reached integration

agreements with the APA (with respect to pilot integration) and the APFA (with respect to flight attendant

integration). American and the TWU participated in arbitration, which process resolved certain unionized ground

employee integration issues in late February and early March 2002. In early April, 2002, the NMB declared

American and TWA LLC a single carrier for labor relations purposes and designated American's incumbent unions

as the collective bargaining representatives of the relevant work groups at both American and TWA LLC. Since

American's unions thereafter represented the relevant employees at both carriers, the integration mechanisms

reached with the unions at American could then begin to be applied. The integration of the unionized work groups

is occurring in accordance with those mechanisms.

F. Fuel

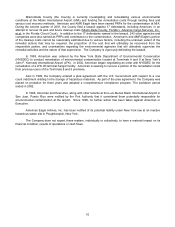

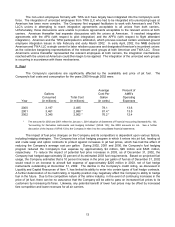

The Company’s operations are significantly affected by the availability and price of jet fuel. The

Company's fuel costs and consumption for the years 2000 through 2002 were:

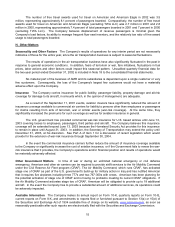

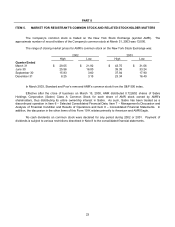

Year

Gallons

Consumed

(in millions)

Total Cost

(in millions)

Average

Cost Per

Gallon

(in cents)

Percent of

AMR's

Operating

Expenses

2000 3,197 2,495 78.1 13.6

2001 3,461 2,888 * 81.4 * 13.5

2002 3,345 2,562 * 76.2 * 12.4

* The amounts for 2002 and 2001 reflect the January 1, 2001 adoption of Statement of Financial Accounting Standards No. 133,

“Accounting for Derivative Instruments and Hedging Activities” (SFAS 133); the 2000 amounts do not. See a further

discussion of the impact of SFAS 133 to the Company in Note 9 to the consolidated financial statements.

The impact of fuel price changes on the Company and its competitors is dependent upon various factors,

including hedging strategies. The Company has a fuel hedging program in which it enters into jet fuel, heating oil

and crude swap and option contracts to protect against increases in jet fuel prices, which has had the effect of

reducing the Company’s average cost per gallon. During 2002, 2001 and 2000, the Company’s fuel hedging

program reduced the Company’s fuel expense by approximately $4 million, $29 million and $545 million,

respectively. To reduce the impact of potential fuel price increases in 2003, as of December 31, 2002, the

Company had hedged approximately 32 percent of its estimated 2003 fuel requirements. Based on projected fuel

usage, the Company estimates that a 10 percent increase in the price per gallon of fuel as of December 31, 2002

would result in an increase to aircraft fuel expense of approximately $205 million in 2003, net of fuel hedge

instruments outstanding at December 31, 2002. The decline in the Company’s credit rating, as discussed in

Liquidity and Capital Resources of Item 7, has limited its ability to enter into certain types of fuel hedge contracts.

A further deterioration of its credit rating or liquidity position may negatively affect the Company’s ability to hedge

fuel in the future. Due to the competitive nature of the airline industry, in the event of continuing increases in the

price of jet fuel, there can be no assurance that the Company will be able to pass on increased fuel prices to its

customers by increasing its fares. Likewise, any potential benefit of lower fuel prices may be offset by increased

fare competition and lower revenues for all air carriers.