American Airlines 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

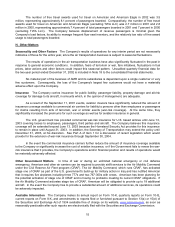

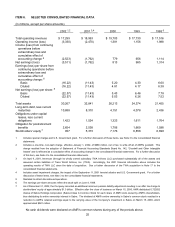

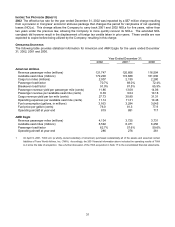

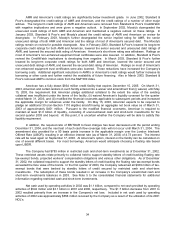

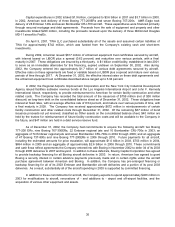

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA

(in millions, except per share amounts)

2002 1,2 2001 3,4 2000 1999 1998 6

Total operating revenues $ 17,299 $ 18,963 $ 19,703 $ 17,730 $ 17,516

Operating income (loss) (3,330) (2,470) 1,381 1,156 1,988

Income (loss) from continuing

operations before

extraordinary loss and

cumulative effect of

accounting change 5(2,523) (1,762) 779 656 1,114

Net earnings (loss) (3,511) (1,762) 813 985 1,314

Earnings (loss) per share from

continuing operations before

extraordinary loss and

cumulative effect of

accounting change: 5

Basic

Diluted

(16.22)

(16.22)

(11.43)

(11.43)

5.20

4.81

4.30

4.17

6.60

6.38

Net earnings (loss) per share: 5

Basic

Diluted

(22.57)

(22.57)

(11.43)

(11.43)

5.43

5.03

6.46

6.26

7.78

7.52

Total assets 30,267 32,841 26,213 24,374 21,455

Long-term debt, less current

maturities 10,888 8,310 4,151 4,078 2,436

Obligations under capital

leases, less current

obligations 1,422 1,524 1,323 1,611 1,764

Obligation for postretirement

benefits 2,654 2,538 1,706 1,669 1,598

Stockholders’ equity 7957 5,373 7,176 6,858 6,698

1 Includes special charges and U.S. Government grant. For a further discussion of these items, see Note 3 to the consolidated financial

statements.

2 Includes a one-time, non-cash charge, effective January 1, 2002, of $988 million, net of tax, to write-off all of AMR’s goodwill. This

charge resulted from the adoption of Statement of Financial Accounting Standards Board No. 142, “Goodwill and Other Intangible

Assets” and is reflected as a cumulative effect of accounting change in the consolidated financial statements. For a further discussion

of this item, see Note 4 to the consolidated financial statements.

3 On April 9, 2001, American (through its wholly owned subsidiary TWA Airlines LLC) purchased substantially all of the assets and

assumed certain liabilities of Trans World Airlines, Inc. (TWA). Accordingly, the 2001 financial information above includes the

operating results of TWA LLC since the date of acquisition. See a further discussion of the TWA acquisition in Note 17 to the

consolidated financial statements.

4 Includes asset impairment charges, the impact of the September 11, 2001 terrorist attacks and U.S. Government grant. For a further

discussion of these items, see Note 3 to the consolidated financial statements.

5 Restated to reflect discontinued operations.

6 The earnings per share amounts reflect the stock split on June 9, 1998.

7 As of December 31, 2002, the Company recorded an additional minimum pension liability adjustment resulting in an after tax charge to

stockholders’ equity of approximately $1.0 billion. Effective after the close of business on March 15, 2000, AMR distributed 0.722652

shares of Sabre Holdings Corporation (Sabre) Class A Common Stock for each share of AMR stock owned by AMR’s shareholders,

thus distributing its entire ownership interest in Sabre. The dividend of AMR’s entire ownership in Sabre’s common stock resulted in a

reduction to AMR’s retained earnings equal to the carrying value of the Company’s investment in Sabre on March 15, 2000, which

approximated $581 million.

No cash dividends were declared on AMR’s common shares during any of the periods above.