American Airlines 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

10. Income Taxes (Continued)

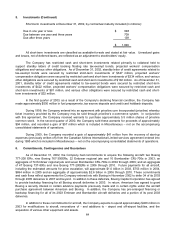

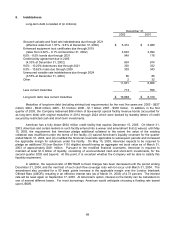

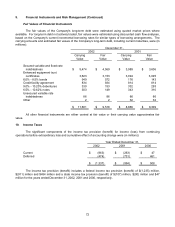

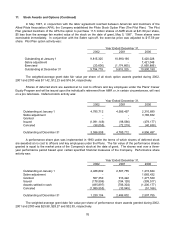

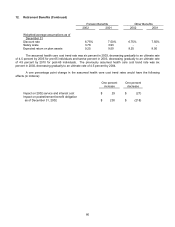

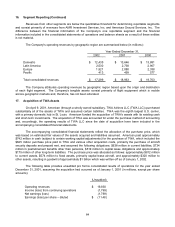

The components of AMR's deferred tax assets and liabilities were (in millions):

December 31,

2002 2001

Deferred tax assets:

Postretirement benefits other than pensions $ 1,005 $ 925

Rent expense 815 765

Alternative minimum tax credit carryforwards 500 572

Operating loss carryforwards 597 412

Pensions 589 -

Frequent flyer obligation 444 409

Gains from lease transactions 185 216

Other 745 784

Valuation allowance (370) (7)

Total deferred tax assets 4,510 4,076

Deferred tax liabilities:

Accelerated depreciation and amortization (4,076) (4,065)

Purchased intangible assets - (369)

Pensions - (157)

Other (434) (322)

Total deferred tax liabilities (4,510) (4,913)

Net deferred tax liability $ - $ (837)

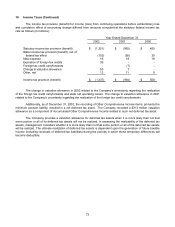

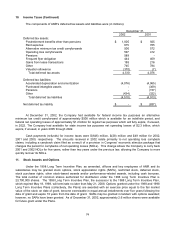

At December 31, 2002, the Company had available for federal income tax purposes an alternative

minimum tax credit carryforward of approximately $500 million which is available for an indefinite period, and

federal net operating losses of approximately $1.2 billion for regular tax purposes which will fully expire, if unused,

in 2022. The Company had available for state income tax purposes net operating losses of $2.3 billion, which

expire, if unused, in years 2005 through 2022.

Cash payments (refunds) for income taxes were $(646) million, $(28) million and $49 million for 2002,

2001 and 2000, respectively. The amounts received in 2002 relate primarily to net operating loss carryback

claims, including a carryback claim filed as a result of a provision in Congress’ economic stimulus package that

changes the period for carrybacks of net operating losses (NOLs). This change allows the Company to carry back

2001 and 2002 NOLs for five years, rather than two years under the previous law, allowing the Company to more

quickly recover its NOLs.

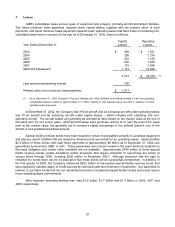

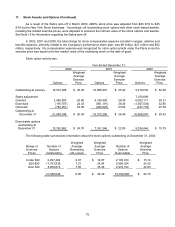

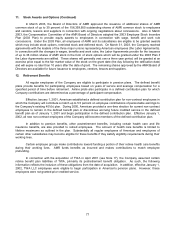

11. Stock Awards and Options

Under the 1998 Long Term Incentive Plan, as amended, officers and key employees of AMR and its

subsidiaries may be granted stock options, stock appreciation rights (SARs), restricted stock, deferred stock,

stock purchase rights, other stock-based awards and/or performance-related awards, including cash bonuses.

The total number of common shares authorized for distribution under the 1998 Long Term Incentive Plan is

23,700,000 shares. The 1998 Long Term Incentive Plan, the successor to the 1988 Long Term Incentive Plan,

which expired May 18, 1998, will terminate no later than May 21, 2008. Options granted under the 1988 and 1998

Long Term Incentive Plans (collectively, the Plans) are awarded with an exercise price equal to the fair market

value of the stock on date of grant, become exercisable in equal annual installments over five years following the

date of grant and expire 10 years from the date of grant. SARs may be granted in tandem with options awarded;

however, no SARs have been granted. As of December 31, 2002, approximately 2.6 million shares were available

for future grant under the Plans.