American Airlines 2002 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

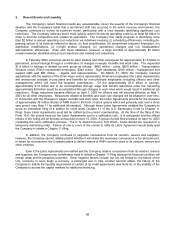

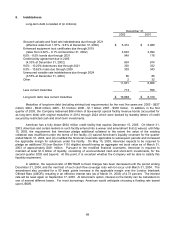

6. Commitments, Contingencies and Guarantees (Continued)

In addition, in its aircraft financing agreements, the Company generally indemnifies the financing parties,

trustees acting on their behalf and other related parties against liabilities (including certain taxes) resulting from the

financing, manufacture, design, ownership, operation and maintenance of the aircraft regardless of whether these

liabilities (or taxes) relate to the negligence of the indemnified parties.

The Company is not able to estimate the potential amount of any liability resulting from the indemnities

discussed above.

Under certain contracts with third parties, the Company indemnifies the third party against legal liability

arising out of an action by the third party, or certain other parties. The terms of these contracts vary and the

potential exposure under these indemnities cannot be determined. Generally, the Company has liability insurance

protecting the Company for its obligations it has undertaken under these indemnities.

AMR and American have event risk covenants in approximately $2.1 billion of indebtedness as of

December 31, 2002. These covenants permit the holders of such indebtedness to receive a higher rate of return

(between 75 and 650 basis points above the stated rate) if a designated event, as defined, should occur and the

credit rating of such indebtedness is downgraded below certain levels within a certain period of time. No

designated event, as defined, has occurred as of December 31, 2002.

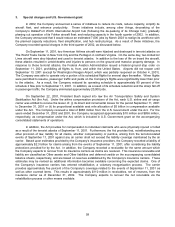

Miami-Dade County is currently investigating and remediating various environmental conditions at the

Miami International Airport (MIA) and funding the remediation costs through landing fees and various cost

recovery methods. American and AMR Eagle have been named as potentially responsible parties (PRPs) for the

contamination at MIA. During the second quarter of 2001, the County filed a lawsuit against 17 defendants,

including American, in an attempt to recover its past and future cleanup costs (Miami-Dade County, Florida v.

Advance Cargo Services, Inc., et al. in the Florida Circuit Court). In addition to the 17 defendants named in the

lawsuit, 243 other agencies and companies were also named as PRPs and contributors to the contamination.

American’s and AMR Eagle’s portion of the cleanup costs cannot be reasonably estimated due to various factors,

including the unknown extent of the remedial actions that may be required, the proportion of the cost that will

ultimately be recovered from the responsible parties, and uncertainties regarding the environmental agencies that

will ultimately supervise the remedial activities and the nature of that supervision. In addition, the Company is

subject to environmental issues at various other airport and non-airport locations for which it has accrued $92

million at December 31, 2002. Management believes, after considering a number of factors, that the ultimate

disposition of these environmental issues is not expected to materially affect the Company’s consolidated financial

position, results of operations or cash flows. Amounts recorded for environmental issues are based on the

Company’s current assessments of the ultimate outcome and, accordingly, could increase or decrease as these

assessments change.

The Company is involved in certain claims and litigation related to its operations. In the opinion of

management, liabilities, if any, arising from these claims and litigation would not have a material adverse effect on

the Company’s consolidated financial position, results of operations, or cash flows.