American Airlines 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Other Information

Environmental Matters Subsidiaries of AMR have been notified of potential liability with regard to several

environmental cleanup sites and certain airport locations. At sites where remedial litigation has commenced,

potential liability is joint and several. AMR's alleged volumetric contributions at these sites are minimal compared

to others. AMR does not expect these matters, individually or collectively, to have a material impact on its results

of operations, financial position or liquidity. Additional information is included in Part D of Item 1 and Note 6 to the

consolidated financial statements.

Critical Accounting Policies and Estimates The preparation of the Company’s financial statements in

conformity with generally accepted accounting principles requires management to make estimates and

assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes.

The Company believes its estimates and assumptions are reasonable; however, actual results and the timing of

the recognition of such amounts could differ from those estimates. The Company has identified the following

critical accounting policies and estimates used by management in the preparation of the Company’s financial

statements: accounting for long-lived assets, passenger revenue, frequent flyer program, pensions and other

postretirement benefits, and income taxes.

Long-lived assets - The Company has approximately $20 billion of long-lived assets as of December 31,

2002, including approximately $19 billion related to flight equipment and other fixed assets. In addition to

the original cost of these assets, their recorded value is impacted by a number of policy elections made by

the Company, including estimated useful lives, salvage values and in 2002 and 2001, impairment charges.

In accordance with Statement of Financial Accounting Standards No. 144, “Accounting for the Impairment or

Disposal of Long-Lived Assets” (SFAS 144), the Company records impairment charges on long-lived assets

used in operations when events and circumstances indicate that the assets may be impaired and the

undiscounted cash flows estimated to be generated by those assets are less than the carrying amount of

those assets. In this circumstance, the impairment charge is determined based upon the amount the net

book value of the assets exceeds their estimated fair market value. In making these determinations, the

Company uses certain assumptions, including, but not limited to: (i) estimated fair market value of the

assets, and (ii) estimated future cash flows expected to be generated by these assets, which are based on

additional assumptions such as asset utilization, length of service the asset will be used in the Company’s

operations and estimated salvage values. Estimates regarding future length of service are most likely to

affect the amount of the impairment charge. During 2001, the Company determined its Fokker 100, Saab

340 and ATR 42 aircraft and related rotables were impaired and recorded impairment charges of

approximately $1.1 billion. In addition, during 2002, upon decisions to reduce the future service lives of

these fleets, the Company determined its Fokker 100, Saab 340, and ATR 42 aircraft and related rotables

were further impaired and recorded an asset impairment charge of approximately $330 million. See Notes 1

and 3 to the consolidated financial statements for additional information with respect to each of the policies

and assumptions used by the Company which affect the recorded values of long-lived assets.

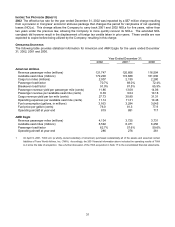

Passenger revenue - Passenger ticket sales are initially recorded as a component of air traffic liability.

Revenue derived from ticket sales is recognized at the time service is provided. However, due to various

factors, including the industry’s pricing structure and interline agreements throughout the industry, certain

amounts are recognized in revenue using estimates regarding both the timing of the revenue recognition

and the amount of revenue to be recognized. These estimates are generally based upon the evaluation of

historical trends, including the use of regression analysis and other methods to model the outcome of future

events based on the Company’s historical experience. Due to changes in the Company’s ticket refund

policy and changes in the profile of customers, historical trends may not be representative of future results.

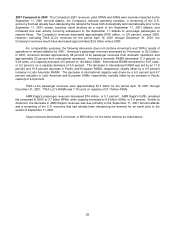

Frequent flyer program - The Company uses a number of estimates in accounting for its AAdvantage

frequent flyer program. Additional information regarding the Company’s AAdvantage frequent flyer program

is included in Part G of Item 1 of this Report. Changes to the percentage of the amount of revenue

deferred, deferred recognition period, cost per mile estimates or the minimum award level accrued could

have a significant impact on the Company’s revenues or incremental cost accrual in the year of the change

as well as in future years.