American Airlines 2002 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

10. Income Taxes (Continued)

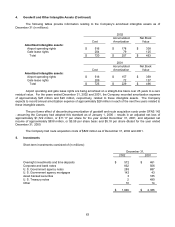

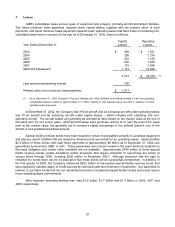

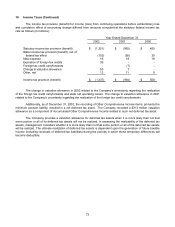

The income tax provision (benefit) for income (loss) from continuing operations before extraordinary loss

and cumulative effect of accounting change differed from amounts computed at the statutory federal income tax

rate as follows (in millions):

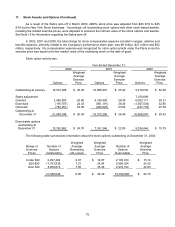

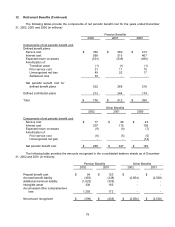

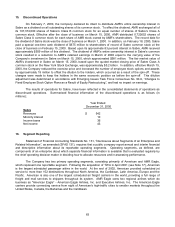

Year Ended December 31,

2002 2001 2000

Statutory income tax provision (benefit) $ (1,351) $ (965) $ 450

State income tax provision (benefit), net of

federal tax effect (103) (58) 30

Meal expense 16 18 19

Expiration of foreign tax credits 39 - -

Foreign tax credit carryforwards - (7) -

Change in valuation allowance 50 7 -

Other, net 12 11 9

Income tax provision (benefit) $ (1,337) $ (994) $ 508

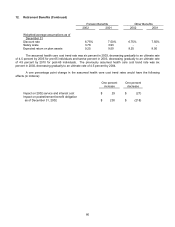

The change in valuation allowance in 2002 related to the Company’s uncertainty regarding the realization

of the foreign tax credit carryforwards and state net operating losses. The change in valuation allowance in 2001

related to the Company’s uncertainty regarding the realization of the foreign tax credit carryforwards.

Additionally, as of December 31, 2002, the recording of Other Comprehensive Income items, primarily the

minimum pension liability, resulted in a net deferred tax asset. The Company recorded a $313 million valuation

allowance as a component of Accumulated Other Comprehensive Income related to such net deferred tax asset.

The Company provides a valuation allowance for deferred tax assets when it is more likely than not that

some portion or all of its deferred tax assets will not be realized. In assessing the realizability of the deferred tax

assets, management considers whether it is more likely than not that some portion or all of the deferred tax assets

will be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable

income (including reversals of deferred tax liabilities) during the periods in which those temporary differences will

become deductible.