American Airlines 2002 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

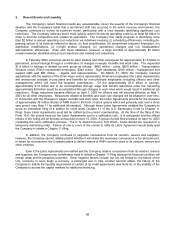

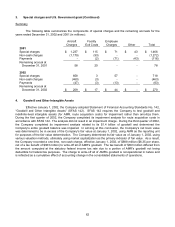

4. Goodwill and Other Intangible Assets (Continued)

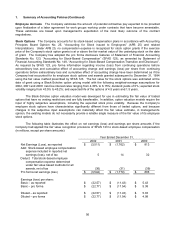

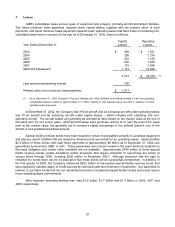

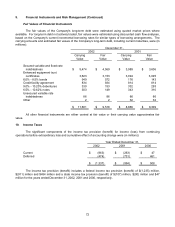

The following tables provide information relating to the Company’s amortized intangible assets as of

December 31 (in millions):

2002

Cost

Accumulated

Amortization

Net Book

Value

Amortized intangible assets:

Airport operating rights $ 516 $ 178 $ 338

Gate lease rights 204 79 125

Total $ 720 $ 257 $ 463

2001

Cost

Accumulated

Amortization

Net Book

Value

Amortized intangible assets:

Airport operating rights $ 516 $ 157 $ 359

Gate lease rights 209 72 137

Total $ 725 $ 229 $ 496

Airport operating and gate lease rights are being amortized on a straight-line basis over 25 years to a zero

residual value. For the years ended December 31, 2002 and 2001, the Company recorded amortization expense

of approximately $28 million and $29 million, respectively, related to these intangible assets. The Company

expects to record annual amortization expense of approximately $28 million in each of the next five years related to

these intangible assets.

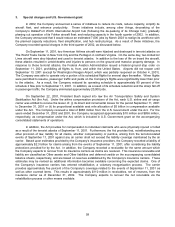

The pro forma effect of discontinuing amortization of goodwill and route acquisition costs under SFAS 142

- assuming the Company had adopted this standard as of January 1, 2000 – results in an adjusted net loss of

approximately $1,722 million, or $11.17 per share for the year ended December 31, 2001, and adjusted net

income of approximately $838 million, or $5.59 per share basic and $5.18 per share diluted for the year ended

December 31, 2000.

The Company had route acquisition costs of $829 million as of December 31, 2002 and 2001.

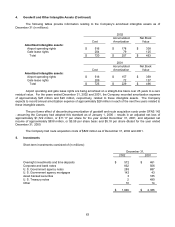

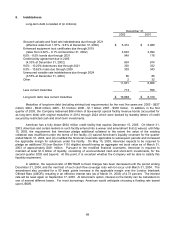

5. Investments

Short-term investments consisted of (in millions):

December 31,

2002 2001

Overnight investments and time deposits $ 572 $ 461

Corporate and bank notes 832 506

U. S. Government agency notes 285 687

U. S. Government agency mortgages 142 43

Asset backed securities 3 185

U. S. Treasury notes 2 490

Other 10 14

$ 1,846 $ 2,386