American Airlines 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

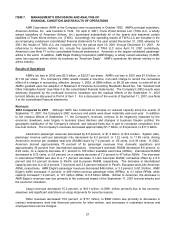

AMR and American’s credit ratings are significantly below investment grade. In June 2002, Standard &

Poor's downgraded the credit ratings of AMR and American, and the credit ratings of a number of other major

airlines. The long-term credit ratings of AMR and American were removed from Standard & Poor's CreditWatch

with negative implications and were given a negative outlook. In September 2002, Moody's downgraded the

unsecured credit ratings of both AMR and American and maintained a negative outlook on these ratings. In

January 2003, Standard & Poor's and Moody's placed the credit ratings of AMR and American on review for

downgrade. In February 2003, Moody's further downgraded the senior implied rating for AMR, the senior

unsecured ratings of both AMR and American and the ratings of most of American's secured debt. The Moody's

ratings remain on review for possible downgrade. Also in February 2003, Standard & Poor's lowered its long-term

corporate credit ratings for both AMR and American, lowered the senior secured and unsecured debt ratings of

AMR, and lowered the secured debt rating of American. American's short-term rating was withdrawn. Ratings on

most of American's non-enhanced equipment trust certificates were also lowered. In addition, Standard & Poor's

revised the CreditWatch implications to developing from negative. In March 2003, Standard & Poor's further

lowered its long-term corporate credit ratings for both AMR and American, lowered the senior secured and

unsecured debt ratings of AMR, and lowered the secured debt rating of American. Ratings on most of American's

non-enhanced equipment trust certificates were also lowered. These reductions have increased the Company’s

borrowing costs. Additional significant reductions in AMR's or American's credit ratings would further increase its

borrowing or other costs and further restrict the availability of future financing. Also in March 2003, Standard &

Poor’s removed AMR’s common stock from the S&P 500 index.

American has a fully drawn $834 million credit facility that expires December 15, 2005. On March 31,

2003, American and certain lenders in such facility entered into a waiver and amendment that (i) waived, until May

15, 2003, the requirement that American pledge additional collateral to the extent the value of the existing

collateral was insufficient under the terms of the facility, (ii) waived American’s liquidity covenant for the quarter

ended March 31, 2003, and (iii) modified the financial covenants applicable to subsequent periods and increased

the applicable margin for advances under the facility. On May 15, 2003, American expects to be required to

pledge an additional 30 (non-Section 1110 eligible) aircraft having an aggregate net book value as of March 31,

2003 of approximately $451 million. Pursuant to the modified financial covenants, American is required to

maintain at least $1.0 billion of liquidity, consisting of unencumbered cash and short-term investments for the

second quarter 2003 and beyond. At this point, it is uncertain whether the Company will be able to satisfy this

liquidity requirement.

In addition, the required ratio of EBITDAR to fixed charges has been decreased until the period ending

December 31, 2004, and the next test of such cash flow coverage ratio will not occur until March 31, 2004. The

amendment also provided for a 50 basis points increase in the applicable margin over the London Interbank

Offered Rate (LIBOR), resulting in an effective interest rate (as of March 31, 2003) of 4.73 percent. The interest

rate will be reset again on September 17, 2003. At American's option, interest on the facility can be calculated on

one of several different bases. For most borrowings, American would anticipate choosing a floating rate based

upon LIBOR.

The Company had $783 million in restricted cash and short-term investments as of December 31, 2002.

These restricted assets relate primarily to collateral held to support standby letters of credit backing floating rate

tax-exempt bonds, projected workers’ compensation obligations and various other obligations. As of December

31, 2002, the collateral required to support the standby letters of credit backing the floating rate tax-exempt bonds

exceeded the face value of the bonds. In the first quarter of 2003, the Company redeemed all $339 million of tax-

exempt bonds that were backed by standby letters of credit secured by restricted cash and short-term

investments. The redemption of these bonds resulted in an increase in the Company’s unrestricted cash and

short-term investments balances in 2003. See Note 5 to the consolidated financial statements for additional

information regarding restricted cash and short-term investments.

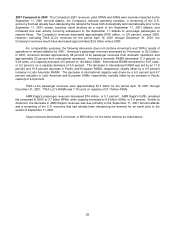

Net cash used by operating activities in 2002 was $1.1 billion, compared to net cash provided by operating

activities of $542 million and $3.1 billion in 2001 and 2000, respectively. The $1.7 billion decrease from 2001 to

2002 resulted primarily from an increase in the Company’s net loss. Included in net cash used by operating

activities of 2002 was approximately $658 million received by the Company as a result of the utilization of its 2001

NOL’s.