American Airlines 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

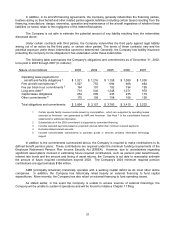

Liquidity and Capital Resources

In response to the September 11, 2001 terrorist attacks, the Company initiated the following measures:

reduced capacity by approximately 20 percent, grounded aircraft and deferred certain aircraft deliveries to future

years, significantly reduced capital spending, closed facilities, reduced its workforce (see Note 3 to the

consolidated financial statements for additional information) and implemented numerous other cost reduction

initiatives.

In 2002, given, among other things: (i) the steep fall-off in demand for air travel, particularly business

travel, caused by the continuing weakness of the U.S. economy, (ii) reduced pricing power, resulting mainly from

greater cost sensitivity on the part of travelers, especially business travelers, and increasing competition from low

cost carriers, and (iii) the residual effects of September 11, the Company announced a series of initiatives to

further reduce its costs, simplify its aircraft fleet, and enhance productivity. These initiatives included, among other

things, de-peaking of the Company’s Dallas/Fort Worth International Airport hub (following the de-peaking of its

Chicago hub); gradually phasing out operation of its Fokker aircraft fleet; and reducing capacity in the fourth

quarter of 2002. In addition, the Company reduced its workforce to better align its workforce with the planned

capacity reductions, fleet simplification, and hub restructurings. Despite the Company’s on-going efforts to reduce

its costs, many of its costs are attributable to factors largely beyond the Company’s control, including (i) escalating

fuel prices, (ii) increased insurance costs and (iii) increased security costs.

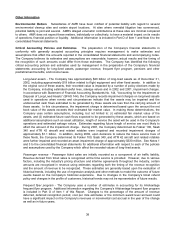

As discussed in Part A of Item 1, the Company’s recent financial results are unsustainable. Given the

severity of the Company's financial situation and the Company’s belief that a permanent shift has occurred in the

airline revenue environment, the Company continues to review its business model, particularly with a view towards

identifying significant cost reductions. The Company believes that it must quickly reduce its annual operating

costs by at least $4 billion in order to become competitive and sustain its operations. The Company has made

progress in identifying more than $2 billion in annual operating cost reductions via initiatives involving: (i)

scheduling efficiencies, including de-peaking certain of its hubs as referred to above, (ii) fleet simplification, (iii)

streamlined customer interaction, (iv) distribution modifications, (v) in-flight product changes, (vi) operational

changes and (vii) headquarters/administration efficiencies. Even with these initiatives, however, a large shortfall of

approximately $2 billion remains between identified annual cost reductions and needed cost reductions.

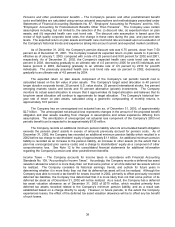

In February 2003, American asked its labor leaders and other employees for approximately $1.8 billion in

permanent, annual savings through a combination of changes in wages, benefits and work rules. The requested

$1.8 billion in savings is divided by work group as follows: $660 million - pilots, $620 million - Transportation

Workers Union (TWU) represented employees, $340 million - flight attendants, $100 million - management and

support staff, and $80 million - agents and representatives. On March 31, 2003, the Company reached

agreements with the leaders of the three major unions representing American employees (the Labor Agreements)

and announced changes in pay plans and benefits for non-unionized employees (including officers and other

management) which will meet the targeted contributions. Of the approximately $1.8 billion in savings,

approximately $1.0 billion are to be accomplished through wage and benefit reductions while the remaining

approximately $.8 billion would be accomplished through changes in work rules which would result in additional job

reductions. Wage reductions became effective on April 1, 2003 for officers and will become effective on May 1,

2003 for all other employees. Reductions related to benefits and work rule changes will be phased in over time.

In connection with the changes in wages, benefits and work rules, the Labor Agreements provide for the issuance

of approximately 38 million shares of AMR stock in the form of stock options which will generally vest over a three

year period (see Note 11 to the consolidated financial statements for additional information). Although these

Labor Agreements enabled the Company to avoid an immediate filing of a petition for relief under Chapter 11 of

the U.S. Bankruptcy Code (a Chapter 11 filing), these Labor Agreements must still be ratified by the unions’

memberships. At the time of the filing of this Form 10-K, the unions have put the Labor Agreements out for a

ratification vote. It is anticipated that the official results of the voting will be formally announced on April 15, 2003.

A group of pilots filed a lawsuit on April 14, 2003 contesting the union ratification process. The U. S. District Court

in Fort Worth, Texas denied the request for a temporary restraining order. Failure of one or more of the unions to

ratify its Labor Agreement would likely lead the Company to initiate a Chapter 11 filing.