American Airlines 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

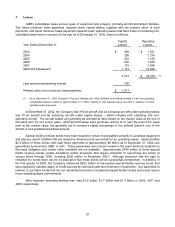

7. Leases

AMR's subsidiaries lease various types of equipment and property, primarily aircraft and airport facilities.

The future minimum lease payments required under capital leases, together with the present value of such

payments, and future minimum lease payments required under operating leases that have initial or remaining non-

cancelable lease terms in excess of one year as of December 31, 2002, were (in millions):

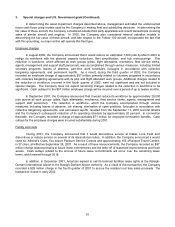

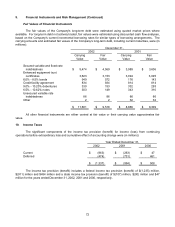

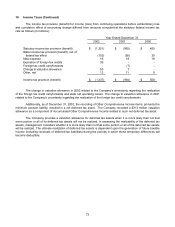

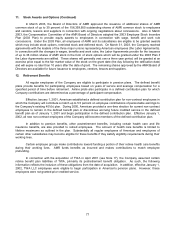

Year Ending December 31,

Capital

Leases

Operating

Leases

2003 $ 254 $ 1,521

2004 299 1,216

2005 233 1,158

2006 235 1,089

2007 179 1,038

2008 and subsequent 1,113 10,296

2,313 $ 16,318 (1)

Less amount representing interest 736

Present value of net minimum lease payments $ 1,577

(1) As of December 31, 2002, included in Accrued liabilities and Other liabilities and deferred credits on the accompanying

consolidated balance sheets is approximately $1.7 billion relating to rent expense being recorded in advance of future

operating lease payments.

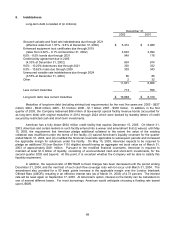

At December 31, 2002, the Company had 318 jet aircraft and 34 turboprop aircraft under operating leases

and 70 jet aircraft and 55 turboprop aircraft under capital leases – which includes both operating and non-

operating aircraft. The aircraft leases can generally be renewed at rates based on fair market value at the end of

the lease term for one to five years. Most aircraft leases have purchase options at or near the end of the lease

term at fair market value, but generally not to exceed a stated percentage of the defined lessor's cost of the

aircraft or at a predetermined fixed amount.

Special facility revenue bonds have been issued by certain municipalities primarily to purchase equipment

and improve airport facilities that are leased by American and accounted for as operating leases. Approximately

$2.4 billion of these bonds (with total future payments of approximately $6 billion as of December 31, 2002) are

guaranteed by American, AMR, or both. These guarantees can only be invoked in the event American defaults on

the lease obligation and certain other remedies are not available. Approximately $740 million of these special

facility revenue bonds contain mandatory tender provisions that require American to repurchase the bonds at

various times through 2008, including $200 million in November 2003. Although American has the right to

remarket the bonds there can be no assurance that these bonds will be successfully remarketed. In addition, in

the first quarter of 2003, the Company redeemed $253 million of tax-exempt special facility revenue bonds that

were backed by standby letters of credit secured by restricted cash and short-term investments. Any payments to

redeem or purchase bonds that are not remarketed would be considered prepaid facility rentals and would reduce

future operating lease commitments.

Rent expense, excluding landing fees, was $1.6 billion, $1.7 billion and $1.3 billion in 2002, 2001 and

2000, respectively.