American Airlines 2002 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

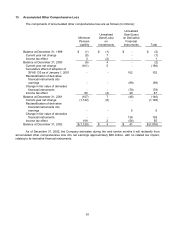

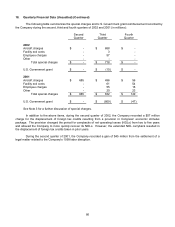

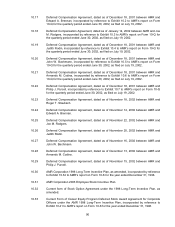

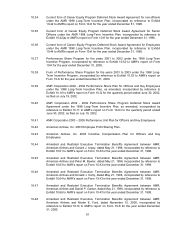

13. Accumulated Other Comprehensive Loss

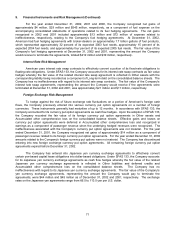

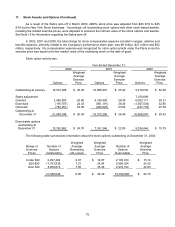

The components of accumulated other comprehensive loss are as follows (in millions):

Minimum

Pension

Liability

Unrealized

Gain/(Loss)

on

Investments

Unrealized

Gain/(Loss)

on Derivative

Financial

Instruments Total

Balance at December 31, 1999 $ (1) $ (1) $ - $ (2)

Current year net change (8) 7 - (1)

Income tax effect 3 (2) - 1

Balance at December 31, 2000 (6) 4 - (2)

Current year net change (161) 5 - (156)

Cumulative effect of adoption of

SFAS 133 as of January 1, 2001 - - 102 102

Reclassification of derivative

financial instruments into

earnings - - (99) (99)

Change in fair value of derivative

financial instruments - - (78) (78)

Income tax effect 60 (2) 29 87

Balance at December 31, 2001 (107) 7 (46) (146)

Current year net change (1,122) (6) - (1,128)

Reclassification of derivative

financial instruments into

earnings - - 5 5

Change in fair value of derivative

financial instruments - - 138 138

Income tax effect 109 2 (56) 55

Balance at December 31, 2002 $ (1,120) $ 3 $ 41 $ (1,076)

As of December 31, 2002, the Company estimates during the next twelve months it will reclassify from

accumulated other comprehensive loss into net earnings approximately $86 million, with no related tax impact,

relating to its derivative financial instruments.