American Airlines 2002 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

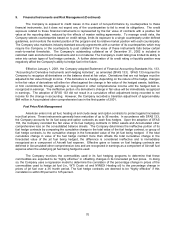

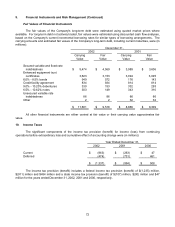

9. Financial Instruments and Risk Management (Continued)

The Company is exposed to credit losses in the event of non-performance by counterparties to these

financial instruments, but it does not expect any of the counterparties to fail to meet its obligations. The credit

exposure related to these financial instruments is represented by the fair value of contracts with a positive fair

value at the reporting date, reduced by the effects of master netting agreements. To manage credit risks, the

Company selects counterparties based on credit ratings, limits its exposure to a single counterparty under defined

guidelines, and monitors the market position of the program and its relative market position with each counterparty.

The Company also maintains industry-standard security agreements with a number of its counterparties which may

require the Company or the counterparty to post collateral if the value of these instruments falls below certain

mark-to-market thresholds. The Company’s outstanding collateral as of December 31, 2002 is included in

restricted cash and short-term investments and is not material. The Company’s credit rating has limited its ability to

enter into certain types of fuel hedge contracts. A further deterioration of its credit rating or liquidity position may

negatively affect the Company’s ability to hedge fuel in the future.

Effective January 1, 2001, the Company adopted Statement of Financial Accounting Standards No. 133,

“Accounting for Derivative Instruments and Hedging Activities”, as amended (SFAS 133). SFAS 133 requires the

Company to recognize all derivatives on the balance sheet at fair value. Derivatives that are not hedges must be

adjusted to fair value through income. If the derivative is a hedge, depending on the nature of the hedge, changes

in the fair value of derivatives will either be offset against the change in fair value of the hedged assets, liabilities,

or firm commitments through earnings or recognized in other comprehensive income until the hedged item is

recognized in earnings. The ineffective portion of a derivative’s change in fair value will be immediately recognized

in earnings. The adoption of SFAS 133 did not result in a cumulative effect adjustment being recorded to net

income for the change in accounting. However, the Company recorded a transition adjustment of approximately

$64 million in Accumulated other comprehensive loss in the first quarter of 2001.

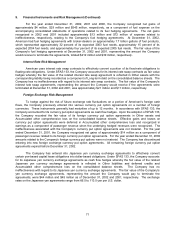

Fuel Price Risk Management

American enters into jet fuel, heating oil and crude swap and option contracts to protect against increases

in jet fuel prices. These instruments generally have maturities of up to 36 months. In accordance with SFAS 133,

the Company accounts for its fuel swap and option contracts as cash flow hedges. Upon the adoption of SFAS

133, the Company recorded the fair value of its fuel hedging contracts in Other assets and Accumulated other

comprehensive loss on the consolidated balance sheets. The Company determines the ineffective portion of its

fuel hedge contracts by comparing the cumulative change in the total value of the fuel hedge contract, or group of

fuel hedge contracts, to the cumulative change in the forecasted value of the jet fuel being hedged. If the total

cumulative change in value of the fuel hedge contract more than offsets the total cumulative change in the

forecasted value of the jet fuel being hedged, the difference is considered ineffective and is immediately

recognized as a component of Aircraft fuel expense. Effective gains or losses on fuel hedging contracts are

deferred in Accumulated other comprehensive loss and are recognized in earnings as a component of Aircraft fuel

expense when the underlying jet fuel being hedged is used.

The Company monitors the commodities used in its fuel hedging programs to determine that these

commodities are expected to be “highly effective” in offsetting changes in its forecasted jet fuel prices. In doing

so, the Company uses a regression model to determine the correlation of the percentage change in prices of the

commodities used to hedge jet fuel (i.e., WTI Crude oil and NYMEX Heating oil) to the percentage change in

prices of jet fuel over a 36 month period. The fuel hedge contracts are deemed to be “highly effective” if this

correlation is within 80 percent to 125 percent.