American Airlines 2002 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

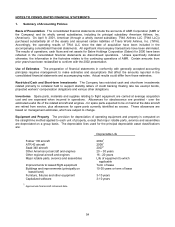

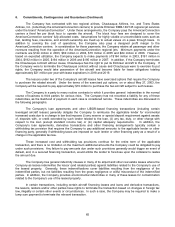

1. Summary of Accounting Policies (Continued)

New Accounting Pronouncements In June 2002, the Financial Accounting Standards Board issued Statements

of Financial Accounting Standards No. 146, “Accounting for Costs Associated with Exit or Disposal Activities”

(SFAS 146). SFAS 146 requires that a liability for a cost associated with an exit or disposal activity be recognized

when the liability is incurred, and establishes that fair value is the objective for initial measurement of the liability.

Prior to SFAS 146, a liability for costs associated with an exit or disposal activity was recognized as of the date of

the commitment to an exit plan. The provisions of SFAS 146 are effective for exit or disposal activities that are

initiated after December 31, 2002. The adoption of SFAS 146 will affect the timing and recognition of certain costs

associated with future exit or disposal activities.

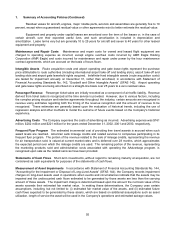

In November 2002, the Financial Accounting Standards Board issued Financial Accounting Standards

Board Interpretation No. 45, “Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including

Indirect Guarantees of Indebtedness of Others” (Interpretation 45). Interpretation 45 requires disclosures in

interim and annual financial statements about obligations under certain guarantees issued by the Company.

Furthermore, it requires recognition at the beginning of a guarantee of a liability for the fair value of the obligation

undertaken in issuing the guarantee, with limited exceptions including: 1) a parent’s guarantee of a subsidiary’s

debt to a third party, and 2) a subsidiary’s guarantee of the debt owed to a third party by either its parent or another

subsidiary of that parent. The disclosure requirements are effective for this filing and are included in Note 6 to the

consolidated financial statements. The initial recognition and initial measurement provisions are only applicable on

a prospective basis for guarantees issued or modified after December 31, 2002.

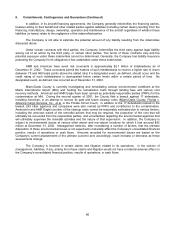

In January 2003, the Financial Accounting Standards Board issued Financial Accounting Standards Board

Interpretation No. 46, “Consolidation of Variable Interest Entities” (Interpretation 46). Interpretation 46 addresses

consolidation of variable interest entities, as defined, previously generally referred to as special purpose entities, to

which the usual condition for consolidation described in Accounting Research Bulletin No. 51, “Consolidated

Financial Statements” does not apply. It requires the primary beneficiary of a variable interest entity to include the

assets, liabilities, and results of the activities of the variable interest entity in its consolidated financial statements,

as well as disclosure of information about the assets and liabilities, and the nature, purpose and activities of

consolidated variable interest entities. In addition, Interpretation 46 requires disclosure of information about the

nature, purpose and activities of unconsolidated variable interest entities in which the Company holds a significant

variable interest. The provisions of Interpretation 46 are effective immediately for any variable interest entities

acquired after January 31, 2003 and effective beginning in the third quarter of 2003 for all variable interest entities

acquired before February 1, 2003. The Company is currently evaluating the impact of Interpretation 46.

In June 2002, the Financial Accounting Standards Board (FASB) issued Statement of Financial

Accounting Standards 145, "Rescission of FASB Statements No. 4, 44, and 64, Amendment of FASB Statement

No. 13, and Technical Corrections” (SFAS 145). SFAS 145 rescinds FASB Statement No. 4, “Reporting Gains

and Losses from Extinguishment of Debt” (SFAS 4), and an amendment of that Statement, FASB Statement No.

64, “Extinguishments of Debt Made to Satisfy Sinking-Fund Requirements” and FASB Statement No. 44,

“Accounting for Intangible Assets of Motor Carriers”. SFAS 145 amends FASB Statement No. 13, “Accounting for

Leases” (SFAS 13), to eliminate an inconsistency between the required accounting for sale-leaseback

transactions and the required accounting for certain lease modifications that have economic effects that are

similar to sale-leaseback transactions and other related pronouncements that make various technical corrections,

clarify meanings, or describe their applicability under changed conditions. The provisions of SFAS 145 related to

the rescission of SFAS 4 are effective for fiscal years beginning after May 15, 2002. Any gain or loss on

extinguishment of debt that was classified as an extraordinary item in prior periods that does not meet the criteria

in FASB Opinion 30 for classification as an extraordinary item must be reclassified. The provisions of SFAS 145

related to SFAS 13 are effective for transactions occurring after May 15, 2002. All other provisions SFAS 145 are

effective for financial statements issued on or after May 15, 2002. SFAS 145 had no impact on the Company

during 2002.