American Airlines 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

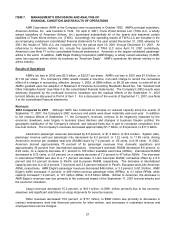

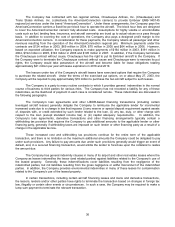

Capital expenditures in 2002 totaled $1.9 billion, compared to $3.6 billion in 2001 and $3.7 billion in 2000.

In 2002, American took delivery of three Boeing 777-200ERs and seven Boeing 757-200s. AMR Eagle took

delivery of 28 Embraer 140s and seven Bombardier CRJ-700 aircraft. These expenditures were financed primarily

through secured mortgage and debt agreements. Proceeds from the sale of equipment and property and other

investments totaled $220 million, including the proceeds received upon the delivery of three McDonnell Douglas

MD-11 aircraft to FedEx.

On April 9, 2001, TWA LLC purchased substantially all of the assets and assumed certain liabilities of

TWA for approximately $742 million, which was funded from the Company’s existing cash and short-term

investments.

During 2002, American issued $617 million of enhanced equipment trust certificates secured by aircraft,

with interest based on LIBOR plus a spread (0.62 percent) and maturities over various periods, with a final

maturity in 2007. These obligations are insured by a third party. A $1 billion credit facility, established in late 2001

to serve as an immediate alternative for this financing, expired undrawn on September 30, 2002. Also during

2002, the Company entered into approximately $1.7 billion of various debt agreements secured by aircraft.

Effective rates on these agreements are fixed or variable based on LIBOR plus a spread and mature over various

periods of time through 2017. At December 31, 2002, the effective interest rates on these debt agreements and

the enhanced equipment trust certificates described above ranged up to 5.94 percent.

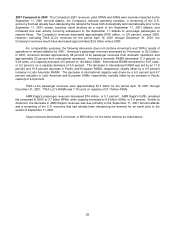

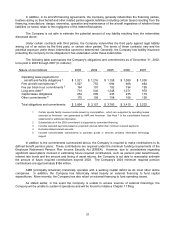

In 2002, the Regional Airports Improvement Corporation and the New York City Industrial Development

Agency issued facilities sublease revenue bonds at the Los Angeles International Airport and John F. Kennedy

International Airport, respectively, to provide reimbursement to American for certain facility construction and other

related costs. The Company has recorded the total amount of the issuances of $759 million (net of $38 million

discount) as long-term debt on the consolidated balance sheet as of December 31, 2002. These obligations bear

interest at fixed rates, with an average effective rate of 8.54 percent, and mature over various periods of time, with

a final maturity in 2028. The Company has received approximately $672 million in reimbursements of certain

facility construction and other related costs through December 31, 2002. Of the remaining $87 million of bond

issuance proceeds not yet received, classified as Other assets on the consolidated balance sheet, $40 million are

held by the trustee for reimbursement of future facility construction costs and will be available to the Company in

the future, and $47 million are held in a debt service reserve fund.

As of December 31, 2002, the Company had commitments to acquire the following aircraft: two Boeing

777-200 ERs, nine Boeing 767-300ERs, 22 Embraer regional jets and 10 Bombardier CRJ-700s in 2003; an

aggregate of 74 Embraer regional jets and seven Bombardier CRJ-700s in 2004 through 2006; and an aggregate

of 47 Boeing 737-800s and nine Boeing 777-200ERs in 2006 through 2010. Future payments for all aircraft,

including the estimated amounts for price escalation, will approximate $1.0 billion in 2003, $753 million in 2004,

$694 million in 2005 and an aggregate of approximately $2.6 billion in 2006 through 2010. These commitments

and cash flows reflect agreements the Company entered into with Boeing in November 2002 to defer 34 of its 2003

through 2005 deliveries to 2007 and beyond. In addition to these deferrals, Boeing Capital Corporation has agreed

to provide backstop financing for all Boeing aircraft deliveries in 2003. In return, American has agreed to grant

Boeing a security interest in certain advance payments previously made and in certain rights under the aircraft

purchase agreement between American and Boeing. In addition, the Company has pre-arranged financing or

backstop financing for all of its 2003 Embraer and Bombardier aircraft deliveries and a portion of its post 2003

deliveries. As a result, substantially all of the aircraft spending in 2003 is supported by committed financing.

In addition to these commitments for aircraft, the Company expects to spend approximately $400 million in

2003 for modifications to aircraft, renovations of - and additions to - airport and off-airport facilities, and the

acquisition of various other equipment and assets.