American Airlines 2002 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

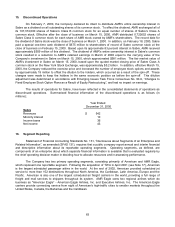

15. Discontinued Operations

On February 7, 2000, the Company declared its intent to distribute AMR’s entire ownership interest in

Sabre as a dividend on all outstanding shares of its common stock. To effect the dividend, AMR exchanged all of

its 107,374,000 shares of Sabre’s Class B common stock for an equal number of shares of Sabre’s Class A

common stock. Effective after the close of business on March 15, 2000, AMR distributed 0.722652 shares of

Sabre Class A common stock for each share of AMR stock owned by AMR’s shareholders. The record date for

the dividend of Sabre stock was the close of business on March 1, 2000. In addition, on February 18, 2000, Sabre

paid a special one-time cash dividend of $675 million to shareholders of record of Sabre common stock at the

close of business on February 15, 2000. Based upon its approximate 83 percent interest in Sabre, AMR received

approximately $559 million of this dividend. The dividend of AMR’s entire ownership interest in Sabre’s common

stock resulted in a reduction to AMR’s retained earnings in March of 2000 equal to the carrying value of the

Company’s investment in Sabre on March 15, 2000, which approximated $581 million. The fair market value of

AMR’s investment in Sabre on March 15, 2000, based upon the quoted market closing price of Sabre Class A

common stock on the New York Stock Exchange, was approximately $5.2 billion. In addition, effective March 15,

2000, the Company reduced the exercise price and increased the number of employee stock options and awards

by approximately 19 million to offset the dilution to the holders, which occurred as a result of the spin-off. These

changes were made to keep the holders in the same economic position as before the spin-off. This dilution

adjustment was determined in accordance with Emerging Issues Task Force Consensus No. 90-9, “Changes to

Fixed Employee Stock Option Plans as a Result of Equity Restructuring”, and had no impact on earnings.

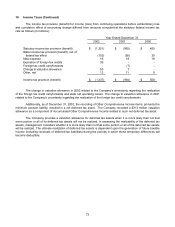

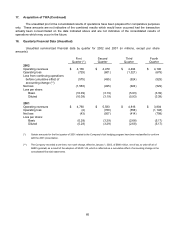

The results of operations for Sabre, have been reflected in the consolidated statements of operations as

discontinued operations. Summarized financial information of the discontinued operations is as follows (in

millions):

Year Ended

December 31, 2000

Sabre

Revenues $ 542

Minority interest 10

Income taxes 36

Net income 43

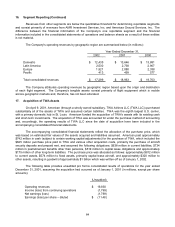

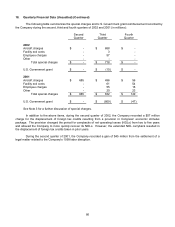

16. Segment Reporting

Statement of Financial Accounting Standards No. 131, “Disclosures about Segments of an Enterprise and

Related Information”, as amended (SFAS 131), requires that a public company report annual and interim financial

and descriptive information about its reportable operating segments. Operating segments, as defined, are

components of an enterprise about which separate financial information is available that is evaluated regularly by

the chief operating decision maker in deciding how to allocate resources and in assessing performance.

The Company has two primary operating segments, consisting primarily of American and AMR Eagle,

which represent one reportable segment. Following the acquisition of TWA in April 2001 (see Note 17), American

is the largest scheduled passenger airline in the world. At the end of 2002, American provided scheduled jet

service to more than 152 destinations throughout North America, the Caribbean, Latin America, Europe and the

Pacific. American is also one of the largest scheduled air freight carriers in the world, providing a full range of

freight and mail services to shippers throughout its system. AMR Eagle owns two regional airlines which do

business as "American Eagle” - American Eagle Airlines, Inc. and Executive Airlines, Inc. The American Eagle

carriers provide connecting service from eight of American's high-traffic cities to smaller markets throughout the

United States, Canada, the Bahamas and the Caribbean.