American Airlines 2002 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

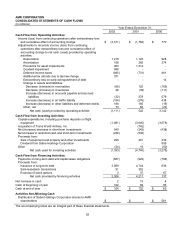

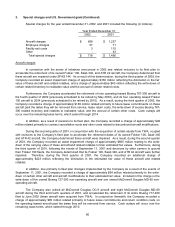

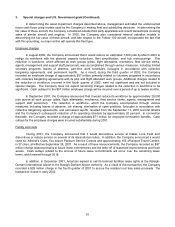

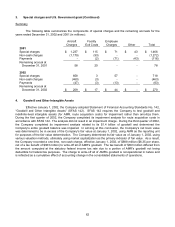

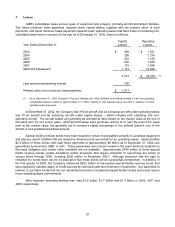

3. Special charges and U.S. Government grant (Continued)

Summary

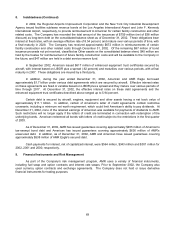

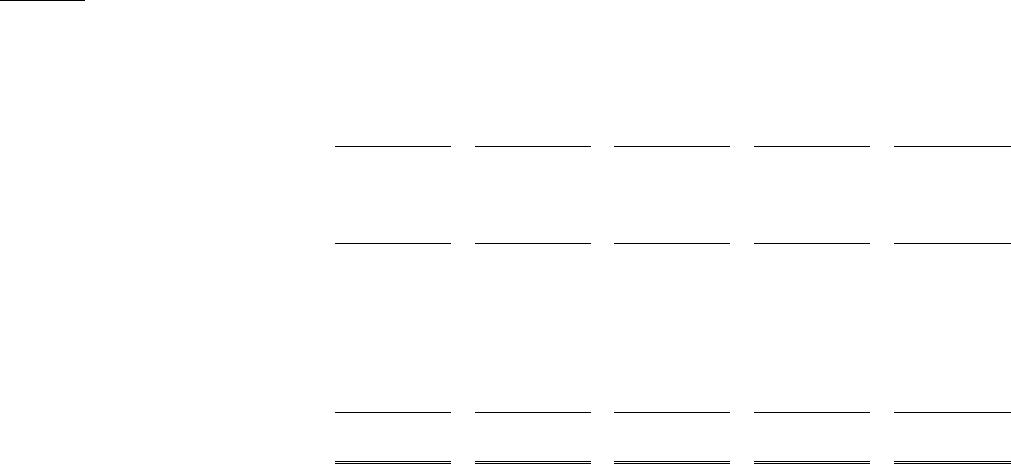

The following table summarizes the components of special charges and the remaining accruals for the

years ended December 31, 2002 and 2001 (in millions):

Aircraft

Charges

Facility

Exit Costs

Employee

Charges Other Total

2001

Special charges $ 1,237 $ 115 $ 71 $ 43 $ 1,466

Non-cash charges (1,179) (93) - - (1,272)

Payments - (2) (71) (43) (116)

Remaining accrual at

December 31, 2001 58 20 - - 78

2002

Special charges 658 3 57 - 718

Non-cash charges (460) (3) - - (463)

Payments (47) (3) (13) - (63)

Remaining accrual at

December 31, 2002 $ 209 $ 17 $ 44 $ - $ 270

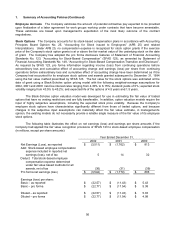

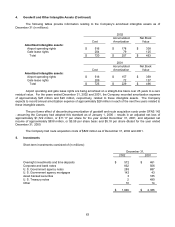

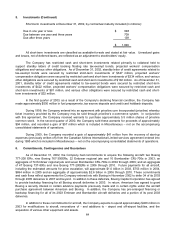

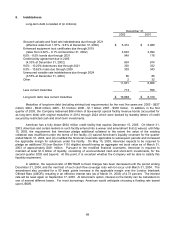

4. Goodwill and Other Intangible Assets

Effective January 1, 2002, the Company adopted Statement of Financial Accounting Standards No. 142,

“Goodwill and Other Intangible Assets” (SFAS 142). SFAS 142 requires the Company to test goodwill and

indefinite-lived intangible assets (for AMR, route acquisition costs) for impairment rather than amortize them.

During the first quarter of 2002, the Company completed its impairment analysis for route acquisition costs in

accordance with SFAS 142. The analysis did not result in an impairment charge. During the third quarter of 2002,

the Company completed its impairment analysis related to its $1.4 billion of goodwill and determined the

Company’s entire goodwill balance was impaired. In arriving at this conclusion, the Company’s net book value

was determined to be in excess of the Company’s fair value at January 1, 2002, using AMR as the reporting unit

for purposes of the fair value determination. The Company determined its fair value as of January 1, 2002, using

various valuation methods, ultimately using market capitalization as the primary indicator of fair value. As a result,

the Company recorded a one-time, non-cash charge, effective January 1, 2002, of $988 million ($6.35 per share,

net of a tax benefit of $363 million) to write-off all of AMR’s goodwill. The tax benefit of $363 million differed from

the amount computed at the statutory federal income tax rate due to a portion of AMR’s goodwill not being

deductible for federal tax purposes. The charge to write-off all of AMR’s goodwill is nonoperational in nature and

is reflected as a cumulative effect of accounting change in the consolidated statements of operations.