American Airlines 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

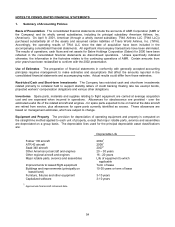

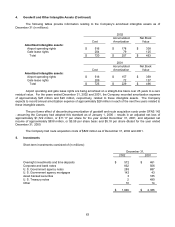

3. Special charges and U.S. Government grant (Continued)

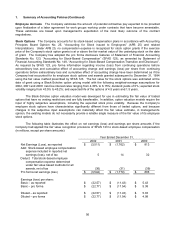

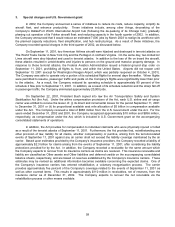

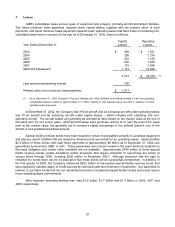

Special charges for the year ended December 31, 2002 and 2001 included the following (in millions):

Year Ended December 31,

2002 2001

Aircraft charges $ 658 $ 1,237

Employee charges 57 71

Facility exit costs 3 115

Other - 43

Total special charges $ 718 $ 1,466

Aircraft charges

In connection with the series of initiatives announced in 2002 and related revisions to its fleet plan to

accelerate the retirement of its owned Fokker 100, Saab 340, and ATR 42 aircraft, the Company determined that

these aircraft are impaired under SFAS 144. As a result of this determination, during the third quarter of 2002, the

Company recorded an asset impairment charge of approximately $330 million reflecting the diminution in the fair

value of these aircraft and related rotables; and a charge of approximately $40 million reflecting the write-down of

certain related inventory to realizable value and the accrual of certain related costs.

Furthermore, the Company accelerated the retirement of nine operating leased Boeing 767-300 aircraft to

the fourth quarter of 2002 (previously scheduled to be retired by May 2003), and its four operating leased Fokker

100 aircraft to 2004 (previously scheduled to be retired by 2010). As a result, during the third quarter of 2002, the

Company recorded a charge of approximately $189 million related primarily to future lease commitments on these

aircraft past the dates they will be removed from service, lease return costs, the write-down of excess Boeing 767-

300 related inventory and rotables to realizable value, and the accrual of certain other costs. Cash outlays will

occur over the remaining lease terms, which extend through 2014.

In addition, as a result of revisions to its fleet plan, the Company recorded a charge of approximately $99

million related primarily to contract cancellation costs and other costs related to discontinued aircraft modifications.

During the second quarter of 2001, in conjunction with the acquisition of certain assets from TWA, coupled

with revisions to the Company’s fleet plan to accelerate the retirement dates of its owned Fokker 100, Saab 340

and ATR 42 aircraft, the Company determined these aircraft were impaired. As a result, during the second quarter

of 2001, the Company recorded an asset impairment charge of approximately $685 million relating to the write-

down of the carrying value of these aircraft and related rotables to their estimated fair values. Furthermore, during

the third quarter of 2001, following the events of September 11, 2001 and decisions by other carriers to ground

their Fokker 100 fleets, the Company determined that its Fokker 100, Saab 340, and ATR 42 aircraft were further

impaired. Therefore, during the third quarter of 2001, the Company recorded an additional charge of

approximately $423 million reflecting the diminution in the estimated fair value of these aircraft and related

rotables.

In addition, due primarily to fleet plan changes implemented by the Company as a result of the events of

September 11, 2001, the Company recorded a charge of approximately $64 million related primarily to the write-

down of certain other aircraft and aircraft modifications to their estimated fair value. Included in this charge is the

write-down of five owned Boeing 727-200 non-operating aircraft and one owned McDonnell Douglas MD-80 non-

operating aircraft.

The Company also retired all McDonnell Douglas DC-9 aircraft and eight McDonnell Douglas MD-80

aircraft during the third and fourth quarters of 2001, and accelerated the retirement of its entire Boeing 717-200

fleet to June 2002 (these aircraft were acquired from TWA). In conjunction therewith, the Company recorded a

charge of approximately $65 million related primarily to future lease commitments and return condition costs on

the operating leased aircraft past the dates they will be removed from service. Cash outlays will occur over the

remaining lease terms, which extend through 2010.