American Airlines 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

In addition, in its aircraft financing agreements, the Company generally indemnifies the financing parties,

trustees acting on their behalf and other related parties against liabilities (including certain taxes) resulting from the

financing, manufacture, design, ownership, operation and maintenance of the aircraft regardless of whether these

liabilities (or taxes) relate to the negligence of the indemnified parties.

The Company is not able to estimate the potential amount of any liability resulting from the indemnities

discussed above.

Under certain contracts with third parties, the Company indemnifies the third party against legal liability

arising out of an action by the third party, or certain other parties. The terms of these contracts vary and the

potential exposure under these indemnities cannot be determined. Generally, the Company has liability insurance

protecting the Company for its obligations it has undertaken under these indemnities.

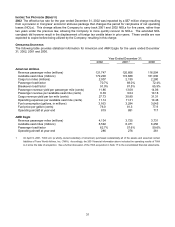

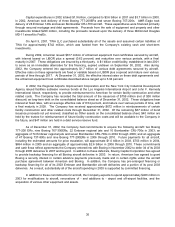

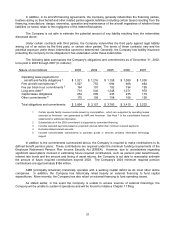

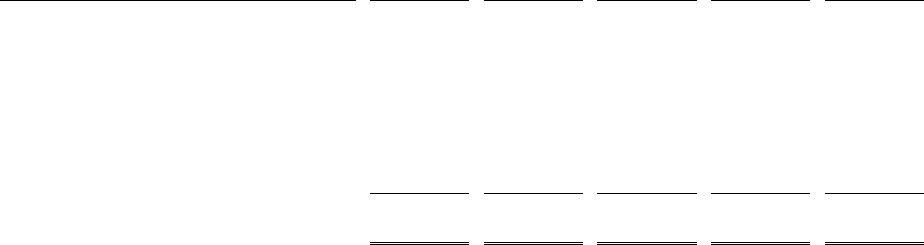

The following table summarizes the Company’s obligations and commitments as of December 31, 2002,

to be paid in 2003 through 2007 (in millions):

Nature of commitment 2003 2004 2005 2006 2007

Operating lease payments for

aircraft and facility obligations 1$ 1,521 $ 1,216 $ 1,158 $ 1,089 $ 1,038

Firm aircraft commitments 21,027 753 694 668 684

Fee per block hour commitments 3164 191 192 194 195

Long-term debt 4713 540 1,348 1,071 978

Capital lease obligations 254 299 233 235 179

Other commitments 5175 158 158 158 158

Total obligations and commitments $ 3,854 $ 3,157 $ 3,783 $ 3,415 $ 3,232

1 Certain special facility revenue bonds issued by municipalities - which are supported by operating leases

executed by American - are guaranteed by AMR and American. See Note 7 to the consolidated financial

statements for additional information.

2 Substantially all of the 2003 commitment is supported by committed financing.

3 Includes expected payments based on projected volumes rather than minimum required payments.

4 Excludes related interest amounts.

5 Includes noncancelable commitments to purchase goods or services, primarily information technology

support.

In addition to the commitments summarized above, the Company is required to make contributions to its

defined benefit pension plans. These contributions are required under the minimum funding requirements of the

Employee Retirement Pension Plan Income Security Act (ERISA). However, due to uncertainties regarding

significant assumptions involved in estimating future required contributions, such as pension plan benefit levels,

interest rate levels and the amount and timing of asset returns, the Company is not able to reasonably estimate

the amount of future required contributions beyond 2003. The Company’s 2003 minimum required pension

contributions are approximately $186 million.

AMR (principally American) historically operates with a working capital deficit as do most other airline

companies. In addition, the Company has historically relied heavily on external financing to fund capital

expenditures. More recently, the Company has also relied on external financing to fund operating losses.

As stated earlier, in the event the Company is unable to access sources of external financings, the

Company will be unable to sustain it operations and will be forced to initiate a Chapter 11 filing.