American Airlines 2002 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of Accounting Policies

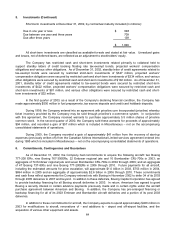

Basis of Presentation The consolidated financial statements include the accounts of AMR Corporation (AMR or

the Company) and its wholly owned subsidiaries, including its principal subsidiary American Airlines, Inc.

(American). On April 9, 2001, American (through a wholly owned subsidiary, TWA Airlines LLC (TWA LLC))

purchased substantially all of the assets and assumed certain liabilities of Trans World Airlines, Inc. (TWA).

Accordingly, the operating results of TWA LLC since the date of acquisition have been included in the

accompanying consolidated financial statements. All significant intercompany transactions have been eliminated.

The results of operations, cash flows and net assets for Sabre Holdings Corporation (Sabre) for 2000 have been

reflected in the consolidated financial statements as discontinued operations. Unless specifically indicated

otherwise, the information in the footnotes relates to the continuing operations of AMR. Certain amounts from

prior years have been reclassified to conform with the 2002 presentation.

Use of Estimates The preparation of financial statements in conformity with generally accepted accounting

principles requires management to make estimates and assumptions that affect the amounts reported in the

consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

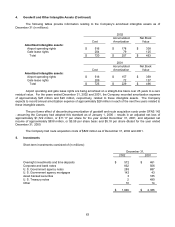

Restricted Cash and Short-term Investments The Company has restricted cash and short-term investments

related primarily to collateral held to support standby letters of credit backing floating rate tax exempt bonds,

projected workers’ compensation obligations and various other obligations.

Inventories Spare parts, materials and supplies relating to flight equipment are carried at average acquisition

cost and are expensed when incurred in operations. Allowances for obsolescence are provided - over the

estimated useful life of the related aircraft and engines - for spare parts expected to be on hand at the date aircraft

are retired from service, plus allowances for spare parts currently identified as excess. These allowances are

based on management estimates, which are subject to change.

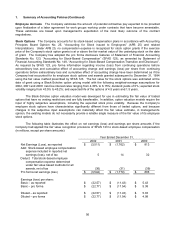

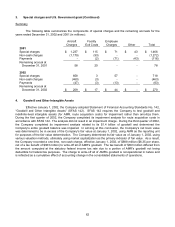

Equipment and Property The provision for depreciation of operating equipment and property is computed on

the straight-line method applied to each unit of property, except that major rotable parts, avionics and assemblies

are depreciated on a group basis. The depreciable lives used for the principal depreciable asset classifications

are:

Depreciable Life

Fokker 100 aircraft 2004 1

ATR 42 aircraft 2008 1

Saab 340 aircraft 2007 1

Other American jet aircraft and engines 20 – 30 years

Other regional aircraft and engines 16 - 20 years

Major rotable parts, avionics and assemblies Life of equipment to which

applicable

Improvements to leased flight equipment Term of lease

Buildings and improvements (principally on

leased land)

10-30 years or term of lease

Furniture, fixtures and other equipment 3-10 years

Capitalized software 3-10 years

1Approximate final aircraft retirement date.