American Airlines 2002 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

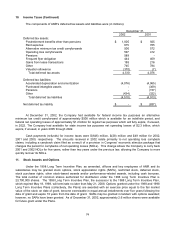

5. Investments (Continued)

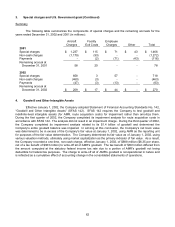

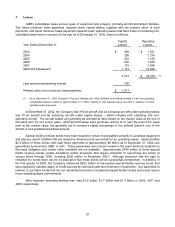

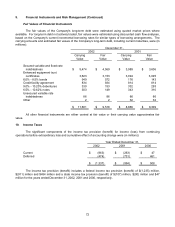

Short-term investments at December 31, 2002, by contractual maturity included (in millions):

Due in one year or less $ 998

Due between one year and three years 709

Due after three years 139

$ 1,846

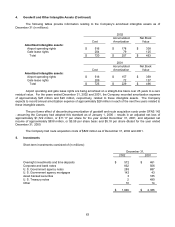

All short-term investments are classified as available-for-sale and stated at fair value. Unrealized gains

and losses, net of deferred taxes, are reflected as an adjustment to stockholders’ equity.

The Company has restricted cash and short-term investments related primarily to collateral held to

support standby letters of credit backing floating rate tax-exempt bonds, projected workers’ compensation

obligations and various other obligations. As of December 31, 2002, standby letter of credit agreements related to

tax-exempt bonds were secured by restricted short-term investments of $347 million, projected workers’

compensation obligations were secured by restricted cash and short-term investments of $334 million, and various

other obligations were secured by restricted cash and short-term investments of $102 million. As of December 31,

2001, standby letter of credit agreements related to tax-exempt bonds were secured by restricted short-term

investments of $422 million, projected workers’ compensation obligations were secured by restricted cash and

short-term investments of $81 million, and various other obligations were secured by restricted cash and short-

term investments of $32 million.

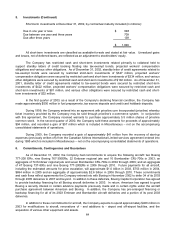

In the first quarter of 2003, as a result of the Company’s declining financial condition, the Company has

made approximately $500 million in fuel prepayments, tax escrow deposits and credit card holdback deposits.

During 1999, the Company entered into an agreement with priceline.com Incorporated (priceline) whereby

ticket inventory provided by the Company may be sold through priceline’s e-commerce system. In conjunction

with this agreement, the Company received warrants to purchase approximately 5.5 million shares of priceline

common stock. In the second quarter of 2000, the Company sold these warrants for proceeds of approximately

$94 million, and recorded a gain of $57 million which is included in Miscellaneous – net on the accompanying

consolidated statements of operations.

During 2000, the Company recorded a gain of approximately $41 million from the recovery of start-up

expenses (previously written-off) from the Canadian Airlines International Limited services agreement entered into

during 1995 which is included in Miscellaneous – net on the accompanying consolidated statements of operations.

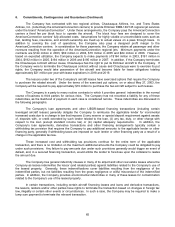

6. Commitments, Contingencies and Guarantees

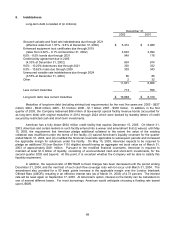

As of December 31, 2002, the Company had commitments to acquire the following aircraft: two Boeing

777-200 ERs, nine Boeing 767-300ERs, 22 Embraer regional jets and 10 Bombardier CRJ-700s in 2003; an

aggregate of 74 Embraer regional jets and seven Bombardier CRJ-700s in 2004 through 2006; and an aggregate

of 47 Boeing 737-800s and nine Boeing 777-200ERs in 2006 through 2010. Future payments for all aircraft,

including the estimated amounts for price escalation, will approximate $1.0 billion in 2003, $753 million in 2004,

$694 million in 2005 and an aggregate of approximately $2.6 billion in 2006 through 2010. These commitments

and cash flows reflect agreements the Company entered into with Boeing in November 2002 to defer 34 of its 2003

through 2005 deliveries to 2007 and beyond. In addition to these deferrals, Boeing Capital Corporation has agreed

to provide backstop financing for all Boeing aircraft deliveries in 2003. In return, American has agreed to grant

Boeing a security interest in certain advance payments previously made and in certain rights under the aircraft

purchase agreement between American and Boeing. In addition, the Company has pre-arranged financing or

backstop financing for all of its 2003 Embraer and Bombardier aircraft deliveries and a portion of its post 2003

deliveries.

In addition to these commitments for aircraft, the Company expects to spend approximately $400 million in

2003 for modifications to aircraft, renovations of - and additions to - airport and off-airport facilities, and the

acquisition of various other equipment and assets.