American Airlines 2002 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

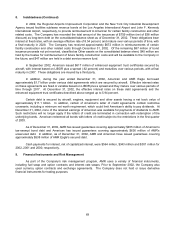

6. Commitments, Contingencies and Guarantees (Continued)

The Company has contracted with two regional airlines, Chautauqua Airlines, Inc. and Trans States

Airlines, Inc. (collectively the AmericanConnection carriers) to provide Embraer EMB-140/145 regional jet services

under the brand “AmericanConnection”. Under these arrangements, the Company pays the AmericanConnection

carriers a fixed fee per block hour to operate the aircraft. The block hour fees are designed to cover the

AmericanConnection carriers’ fully allocated costs. Assumptions for highly volatile or uncontrollable costs such as

fuel, landing fees, insurance, and aircraft ownership are trued up to actual values on a pass through basis. In

addition to covering the cost of operations, the Company also pays a designed profit margin to the

AmericanConnection carriers. In consideration for these payments, the Company retains all passenger and other

revenues resulting from the operation of the AmericanConnection regional jets. Minimum payments under the

contracts are $124 million in 2003, $69 million in 2004, $70 million in 2005 and $64 million in 2006. However,

based on expected utilization, the Company expects to make payments of $164 million in 2003, $191 million in

2004, $192 million in 2005, $194 million in 2006 and $195 million in 2007. In addition, if the Company terminates

the Chautauqua contract without cause, Chautauqua has the right to put its Embraer aircraft to the Company. If

the Company were to terminate the Chautauqua contract without cause and Chautauqua were to exercise its put

rights, the Company would take possession of the aircraft and become liable for lease obligations totaling

approximately $21 million per year with lease expirations in 2018 and 2019.

The lessors under two of the Company’s aircraft leases have exercised options that require the Company

to purchase the related aircraft. Under the terms of the exercised put options, on or about May 27, 2003, the

Company will be required to pay approximately $19 million to purchase the two aircraft subject to such leases.

The Company is a party to many routine contracts in which it provides general indemnities in the normal

course of business to third parties for various risks. The Company has not recorded a liability for any of these

indemnities, as the likelihood of payment in each case is considered remote. These indemnities are discussed in

the following paragraphs.

The Company’s loan agreements and other LIBOR-based financing transactions (including certain

leveraged aircraft leases) generally obligate the Company to reimburse the applicable lender for incremental

increased costs due to a change in law that imposes (i) any reserve or special deposit requirement against assets

of, deposits with, or credit extended by such lender related to the loan, (ii) any tax, duty, or other charge with

respect to the loan (except standard income tax) or (iii) capital adequacy requirements. In addition, the

Company’s loan agreements, derivative transactions and other financing arrangements typically contain a

withholding tax provision that requires the Company to pay additional amounts to the applicable lender or other

financing party, generally if withholding taxes are imposed on such lender or other financing party as a result of a

change in the applicable tax law.

These increased cost and withholding tax provisions continue for the entire term of the applicable

transaction, and there is no limitation on the maximum additional amounts the Company could be obligated to pay

under such provisions. Any failure to pay amounts due under such provisions generally would trigger an event of

default, and, in a secured financing transaction, would entitle the lender to foreclose upon the collateral to realize

the amount due.

The Company has general indemnity clauses in many of its airport and other real estate leases where the

Company as lessee indemnifies the lessor (and related parties) against liabilities related to the Company’s use of

the leased property. Generally, these indemnifications cover liabilities resulting from the negligence of the

indemnified parties, but not liabilities resulting from the gross negligence or willful misconduct of the indemnified

parties. In addition, the Company provides environmental indemnities in many of these leases for contamination

related to the Company’s use of the leased property.

In certain transactions, including certain aircraft financing leases and loans and derivative transactions,

the lessors, lenders and/or other parties have rights to terminate the transaction based on changes in foreign tax

law, illegality or certain other events or circumstances. In such a case, the Company may be required to make a

lump sum payment to terminate the relevant transaction.