American Airlines 2002 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

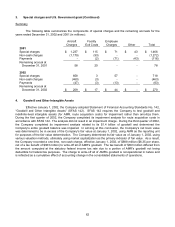

3. Special charges and U.S. Government grant

In 2002, the Company announced a series of initiatives to reduce its costs, reduce capacity, simplify its

aircraft fleet, and enhance productivity. These initiatives include, among other things, de-peaking of the

Company’s Dallas/Fort Worth International Airport hub (following the de-peaking of its Chicago hub); gradually

phasing out operation of its Fokker aircraft fleet; and reducing capacity in the fourth quarter of 2002. In addition,

the Company announced that it would reduce an estimated 7,000 jobs by March 2003 to realign its workforce with

the planned capacity reductions, fleet simplification, and hub restructurings. As a result of these initiatives, the

Company recorded special charges in the third quarter of 2002, as discussed below.

On September 11, 2001, two American Airlines aircraft were hijacked and destroyed in terrorist attacks on

The World Trade Center in New York City and the Pentagon in northern Virginia. On the same day, two United Air

Lines aircraft were also hijacked and used in terrorist attacks. In addition to the loss of life on board the aircraft,

these attacks resulted in untold deaths and injuries to persons on the ground and massive property damage. In

response to those terrorist attacks, the Federal Aviation Administration issued a federal ground stop order on

September 11, 2001, prohibiting all flights to, from, and within the United States. Airports did not reopen until

September 13, 2001 (except for Washington Reagan Airport, which was partially reopened on October 4, 2001).

The Company was able to operate only a portion of its scheduled flights for several days thereafter. When flights

were permitted to resume, passenger traffic and yields on the Company’s flights were significantly lower than prior

to the attacks. As a result, the Company reduced its operating schedule to approximately 80 percent of the

schedule it flew prior to September 11, 2001. In addition, as a result of its schedule reduction and the sharp fall off

in passenger traffic, the Company eliminated approximately 20,000 jobs.

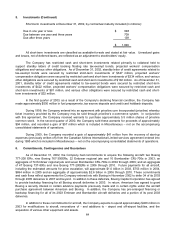

On September 22, 2001, President Bush signed into law the Air Transportation Safety and System

Stabilization Act (the Act). Under the airline compensation provisions of the Act, each U.S. airline and air cargo

carrier was entitled to receive the lesser of: (i) its direct and incremental losses for the period September 11, 2001

to December 31, 2001 or (ii) its proportional available seat mile allocation of $5 billion in compensation available

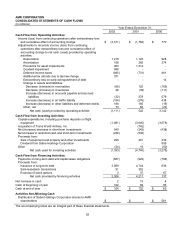

under the Act. The Company received a total of $866 million from the U.S. Government under the Act. For the

years ended December 31, 2002 and 2001, the Company recognized approximately $10 million and $856 million,

respectively, as compensation under the Act, which is included in U.S. Government grant on the accompanying

consolidated statements of operations.

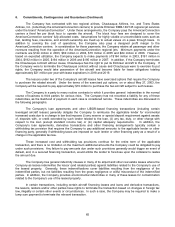

In addition, the Act provides for compensation to individual claimants who were physically injured or killed

as a result of the terrorist attacks of September 11, 2001. Furthermore, the Act provides that, notwithstanding any

other provision of law, liability for all claims, whether compensatory or punitive, arising from the terrorist-related

events of September 11, 2001 against any air carrier shall not exceed the liability coverage maintained by the air

carrier. Based upon estimates provided by the Company’s insurance providers, the Company recorded a liability of

approximately $2.3 billion for claims arising from the events of September 11, 2001, after considering the liability

protections provided for by the Act. In addition, the Company recorded a receivable for the same amount which

the Company expects to recover from its insurance carriers as claims are resolved. This insurance receivable and

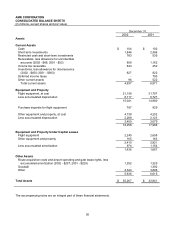

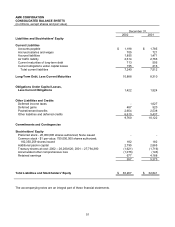

liability are classified as Other assets and Other liabilities and deferred credits on the accompanying consolidated

balance sheets, respectively, and are based on reserves established by the Company’s insurance carriers. These

estimates may be revised as additional information becomes available concerning the expected claims. One of

the Company’s insurance carriers has entered rehabilitation, a voluntary reorganization process. The carrier

provides approximately five percent of the Company’s coverage related to the events of September 11, 2001 as

well as other covered items. This results in approximately $110 million in receivables, net of reserves, from the

insurance carrier as of December 31, 2002. The Company expects to recover the net receivable via the

rehabilitation process or other means available.