American Airlines 2002 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69

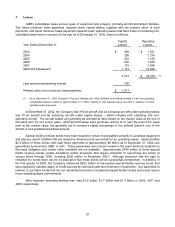

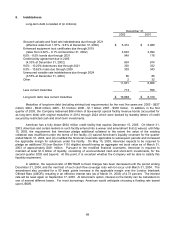

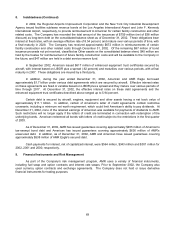

8. Indebtedness (Continued)

In 2002, the Regional Airports Improvement Corporation and the New York City Industrial Development

Agency issued facilities sublease revenue bonds at the Los Angeles International Airport and John F. Kennedy

International Airport, respectively, to provide reimbursement to American for certain facility construction and other

related costs. The Company has recorded the total amount of the issuances of $759 million (net of $38 million

discount) as long-term debt on the consolidated balance sheet as of December 31, 2002. These obligations bear

interest at fixed rates, with an average effective rate of 8.54 percent, and mature over various periods of time, with

a final maturity in 2028. The Company has received approximately $672 million in reimbursements of certain

facility construction and other related costs through December 31, 2002. Of the remaining $87 million of bond

issuance proceeds not yet received, classified as Other assets on the consolidated balance sheet, $40 million are

held by the trustee for reimbursement of future facility construction costs and will be available to the Company in

the future, and $47 million are held in a debt service reserve fund.

In September 2002, American issued $617 million of enhanced equipment trust certificates secured by

aircraft, with interest based on LIBOR plus a spread (.62 percent) and maturities over various periods, with a final

maturity in 2007. These obligations are insured by a third party.

In addition, during the year ended December 31, 2002, American and AMR Eagle borrowed

approximately $1.7 billion under various debt agreements which are secured by aircraft. Effective interest rates

on these agreements are fixed or variable based on LIBOR plus a spread and they mature over various periods of

time through 2017. At December 31, 2002, the effective interest rates on these debt agreements and the

enhanced equipment trust certificates described above ranged up to 5.94 percent.

Certain debt is secured by aircraft, engines, equipment and other assets having a net book value of

approximately $11.1 billion. In addition, certain of American's letter of credit agreements contain restrictive

covenants, including a minimum net worth requirement, which could limit American's ability to pay dividends. At

December 31, 2002, none of the retained earnings of American was available for payments of dividends to AMR.

Such restrictions will no longer apply if the letters of credit are terminated in connection with redemption of the

underlying bonds. American redeemed all bonds with letters of credit subject to the restrictions in the first quarter

of 2003.

As of December 31, 2002, AMR has issued guarantees covering approximately $935 million of American’s

tax-exempt bond debt and American has issued guarantees covering approximately $636 million of AMR’s

unsecured debt. In addition, as of December 31, 2002, AMR and American have issued guarantees covering

approximately $538 million of AMR Eagle’s secured debt.

Cash payments for interest, net of capitalized interest, were $564 million, $343 million and $301 million for

2002, 2001 and 2000, respectively.

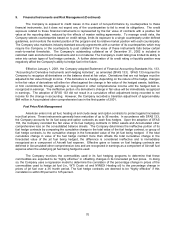

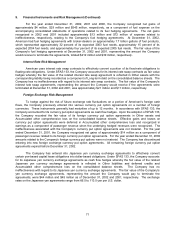

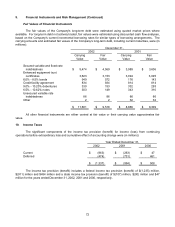

9. Financial Instruments and Risk Management

As part of the Company's risk management program, AMR uses a variety of financial instruments,

including fuel swap and option contracts and interest rate swaps. Prior to September 2002, the Company also

used currency option contracts and exchange agreements. The Company does not hold or issue derivative

financial instruments for trading purposes.