American Airlines 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

AMR Corporation (AMR or the Company) was incorporated in October 1982. AMR's principal subsidiary,

American Airlines, Inc., was founded in 1934. On April 9, 2001, Trans World Airlines LLC (TWA LLC, a wholly

owned subsidiary of American Airlines, Inc.) purchased substantially all of the assets and assumed certain

liabilities of Trans World Airlines, Inc. (TWA). Accordingly, the operating results of TWA LLC are included in the

accompanying condensed consolidated financial statements for the year ended December 31, 2002 whereas for

2001 the results of TWA LLC are included only for the period April 10, 2001 through December 31, 2001. All

references to American Airlines, Inc. include the operations of TWA LLC since April 10, 2001 (collectively,

American) (see Note 17 to the consolidated financial statements). American is the largest scheduled passenger

airline in the world. In addition, AMR Eagle Holding Corporation (AMR Eagle), a wholly owned subsidiary of AMR,

owns two regional airlines which do business as “American Eagle”. AMR’s operations fall almost entirely in the

airline industry.

Results of Operations

AMR’s net loss in 2002 was $3.5 billion, or $22.57 per share. AMR’s net loss in 2001 was $1.8 billion, or

$11.43 per share. The Company’s 2002 results include a one-time, non-cash charge to record the cumulative

effect of a change in accounting, effective January 1, 2002, of $988 million, or $6.35 per share, to write-off all of

AMR’s goodwill upon the adoption of Statement of Financial Accounting Standards Board No. 142 “Goodwill and

Other Intangible Assets” (see Note 4 to the consolidated financial statements). The Company’s 2002 results were

adversely impacted by the continued economic slowdown and the residual effects of the September 11, 2001

terrorist attacks as discussed in Part A of Item 1. For a discussion of the events of September 11, 2001, see Note

3 to the consolidated financial statements.

REVENUES

2002 Compared to 2001 Although traffic has continued to increase on reduced capacity since the events of

September 11, 2001, the Company’s 2002 revenues and yields were down materially year-over-year. In addition

to the residual effects of September 11, the Company’s revenues continue to be negatively impacted by the

economic slowdown, seen largely in business travel declines and changes in business traveler profiles; the

geographic distribution of the Company’s network; and reduced fares due in part to increased competition from

low-cost carriers. The Company’s revenues decreased approximately $1.7 billion, or 8.8 percent, to $17.3 billion.

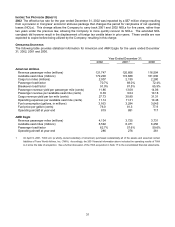

American's passenger revenues decreased by 8.5 percent, or $1.3 billion, to $14.4 billion. System wide,

passenger revenue yield per passenger mile decreased by 9.3 percent, or 1.22 cents, to 11.86 cents, driving

American’s revenue per available seat mile (RASM) down by 7.2 percent, or .65 cents, to 8.39 cents. In 2002,

American derived approximately 70 percent of its passenger revenues from domestic operations and

approximately 30 percent from international operations. American’s domestic RASM decreased 8.8 percent, to

8.26 cents, on a capacity decrease of 1 percent to 125 billion available seat miles (ASMs). International RASM

decreased to 8.72 cents, or 2.8 percent, on a capacity decrease of 7.2 percent to 47 billion ASMs. The decrease

in international RASM was due to a 7.1 percent decrease in Latin American RASM, somewhat offset by a 6.5

percent and 0.3 percent increase in Pacific and European RASM, respectively. The decrease in international

capacity was due to a 22.4 percent, 7.9 percent and 3.3 percent reduction in Pacific, European and Latin American

ASMs, respectively. AMR Eagle’s passenger revenues decreased $46 million, or 3.3 percent, to $1.3 billion. AMR

Eagle’s traffic increased 11 percent, or 409 million revenue passenger miles (RPMs), to 4.1 billion RPMs, while

capacity increased 1.9 percent, or 121 million ASMs, to 6.6 billion ASMs. Similar to American, the decrease in

AMR Eagle’s revenues was due primarily to the continued impact of the September 11, 2001 terrorist attacks and

the economic slowdown.

Cargo revenues decreased 15.3 percent, or $101 million, to $561 million primarily due to the economic

slowdown and significant restrictions on cargo shipments for security reasons.

Other revenues decreased 15.5 percent, or $177 million, to $966 million due primarily to decreases in

contract maintenance work that American performs for other airlines, and decreases in codeshare revenue and

employee travel service charges.