American Airlines 2002 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

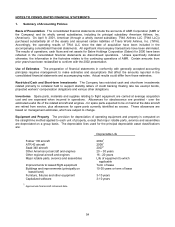

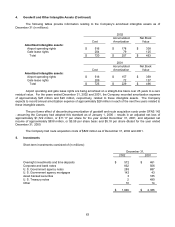

1. Summary of Accounting Policies (Continued)

Residual values for aircraft, engines, major rotable parts, avionics and assemblies are generally five to 10

percent, except when a guaranteed residual value or other agreements exist to better estimate the residual value.

Equipment and property under capital leases are amortized over the term of the leases or, in the case of

certain aircraft, over their expected useful lives, and such amortization is included in depreciation and

amortization. Lease terms vary but are generally 10 to 25 years for aircraft and seven to 40 years for other leased

equipment and property.

Maintenance and Repair Costs Maintenance and repair costs for owned and leased flight equipment are

charged to operating expense as incurred, except engine overhaul costs incurred by AMR Eagle Holding

Corporation (AMR Eagle) and costs incurred for maintenance and repair under power by the hour maintenance

contract agreements, which are accrued on the basis of hours flown.

Intangible Assets Route acquisition costs and airport operating and gate lease rights represent the purchase

price attributable to route authorities (including international airport take-off and landing slots), airport take-off and

landing slots and airport gate leasehold rights acquired. Indefinite-lived intangible assets (route acquisition costs)

are tested for impairment annually on December 31, rather than amortized, in accordance with Statement of

Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets” (SFAS 142). Airport operating

and gate lease rights are being amortized on a straight-line basis over 25 years to a zero residual value.

Passenger Revenue Passenger ticket sales are initially recorded as a component of air traffic liability. Revenue

derived from ticket sales is recognized at the time service is provided. However, due to various factors, including

the complex pricing structure and interline agreements throughout the industry, certain amounts are recognized in

revenue using estimates regarding both the timing of the revenue recognition and the amount of revenue to be

recognized. These estimates are generally based upon the evaluation of historical trends, including the use of

regression analysis and other methods to model the outcome of future events based on the Company’s historical

experience.

Advertising Costs The Company expenses the costs of advertising as incurred. Advertising expense was $161

million, $202 million and $221 million for the years ended December 31, 2002, 2001 and 2000, respectively.

Frequent Flyer Program The estimated incremental cost of providing free travel awards is accrued when such

award levels are reached. American sells mileage credits and related services to companies participating in its

frequent flyer program. The portion of the revenue related to the sale of mileage credits, representing the revenue

for air transportation sold, is valued at current market rates and is deferred over 28 months, which approximates

the expected period over which the mileage credits are used. The remaining portion of the revenue, representing

the marketing products sold and administrative costs associated with operating the AAdvantage program, is

recognized upon sale as the related services have been provided.

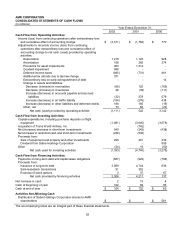

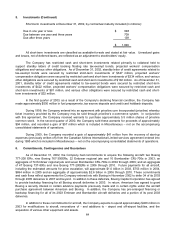

Statements of Cash Flows Short-term investments, without regard to remaining maturity at acquisition, are not

considered as cash equivalents for purposes of the statements of cash flows.

Measurement of Asset Impairments In accordance with Statement of Financial Accounting Standards No. 144,

“Accounting for the Impairment or Disposal of Long-Lived Assets” (SFAS 144), the Company records impairment

charges on long-lived assets used in operations when events and circumstances indicate that the assets may be

impaired and the undiscounted cash flows estimated to be generated by those assets are less than the carrying

amount of those assets. The impairment charge is determined based upon the amount the net book value of the

assets exceeds their estimated fair market value. In making these determinations, the Company uses certain

assumptions, including, but not limited to: (i) estimated fair market value of the assets, and (ii) estimated future

cash flows expected to be generated by these assets, which are based on additional assumptions such as asset

utilization, length of service the asset will be used in the Company’s operations and estimated salvage values.