American Airlines 2002 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2002 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

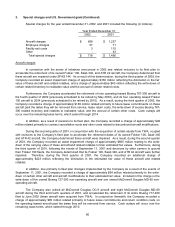

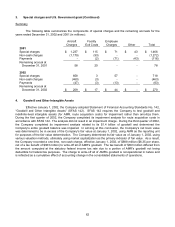

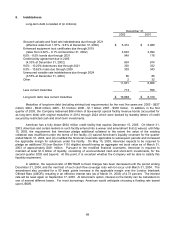

3. Special charges and U.S. Government grant (Continued)

In determining the asset impairment charges described above, management estimated the undiscounted

future cash flows using models used by the Company in making fleet and scheduling decisions. In determining the

fair value of these aircraft, the Company considered outside third party appraisals and recent transactions involving

sales of similar aircraft and engines. In 2002, the Company also considered internal valuation models in

determining the fair value of these aircraft, and with respect to the Fokker 100 aircraft, incorporated the fact that

with this grounding, no major airline will operate this fleet type.

Employee charges

In August 2002, the Company announced that it would reduce an estimated 7,000 jobs by March 2003 to

realign its workforce with the planned capacity reductions, fleet simplification, and hub restructurings. This

reduction in workforce, which affected all work groups (pilots, flight attendants, mechanics, fleet service clerks,

agents, management and support staff personnel), was accomplished through various measures, including limited

voluntary programs, leaves of absence, part-time work schedules, furloughs in accordance with collective

bargaining agreements, and permanent layoffs. As a result, during the third quarter of 2002, the Company

recorded an employee charge of approximately $57 million primarily related to voluntary programs in accordance

with collective bargaining agreements with its pilot and flight attendant work groups. Additional charges related to

the reduction in workforce, incurred in the fourth quarter of 2002, were not significant and are not included in

special charges. The Company does not expect remaining charges related to the reduction in workforce to be

significant. Cash outlays for the $57 million employee charge will be incurred over a period of up to twelve months.

In September 2001, the Company announced that it would reduce its workforce by approximately 20,000

jobs across all work groups (pilots, flight attendants, mechanics, fleet service clerks, agents, management and

support staff personnel). The reduction in workforce, which the Company accomplished through various

measures, including leaves of absence, job sharing, elimination of open positions, furloughs in accordance with

collective bargaining agreements, and permanent layoffs, resulted from the September 11, 2001 terrorist attacks

and the Company’s subsequent reduction of its operating schedule by approximately 20 percent. In connection

therewith, the Company recorded a charge of approximately $71 million for employee termination benefits. Cash

outlays for the employee charges were incurred substantially during 2001.

Facility exit costs

During 2001, the Company announced that it would discontinue service at Dallas Love Field and

discontinue or reduce service on several of its international routes. In addition, the Company announced it would

close six Admiral’s Clubs, five airport Platinum Service Centers and approximately 105 off-airport Travel Centers

in 37 cities, all effective September 28, 2001. As a result of these announcements, the Company recorded an $87

million charge related primarily to future lease commitments and the write-off of leasehold improvements and fixed

assets. Cash outlays related to the accrual of future lease commitments will occur over the remaining lease

terms, which extend through 2018.

In addition, in December 2001, American agreed to sell its terminal facilities lease rights at the Raleigh-

Durham International Airport to the Raleigh-Durham Airport Authority. As a result of this transaction, the Company

recorded a $28 million charge in the fourth quarter of 2001 to accrue the residual cost less sales proceeds. The

transaction closed in early 2002.