Abercrombie & Fitch 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

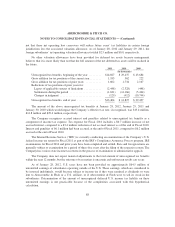

Accordingly, the results of operations of RUEHL are reflected in Income from Discontinued Operations,

Net of Tax on the Consolidated Statements of Operations and Comprehensive Income for the fifty-two

weeks ended January 28, 2012 and January 30, 2010. Results from discontinued operations for the

fifty-two weeks ended January 29, 2011, were immaterial.

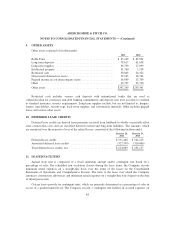

Costs associated with exit or disposal activities are recorded when the liability is incurred. Below is a

roll forward from January 29, 2011 of the liabilities recognized on the Consolidated Balance Sheet as of

January 28, 2012 related to the closure of RUEHL branded stores and related direct-to-consumer operations

(in millions):

Fifty-Two Weeks Ended

January 28, 2012

Beginning Balance .......................................... $17.2

Interest Accretion / Other, Net(1) ................................ (1.3)

Cash Payments ............................................. (15.9)

Ending Balance ............................................. $ —

(1) Other includes an accrual adjustment related to the settlement of outstanding lease obligations.

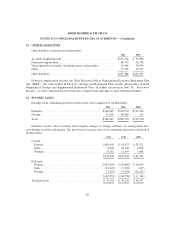

18. RETIREMENT BENEFITS

The Company maintains the Abercrombie & Fitch Co. Savings & Retirement Plan, a qualified plan.

All U.S. associates are eligible to participate in this plan if they are at least 21 years of age and have

completed a year of employment with 1,000 or more hours of service. In addition, the Company maintains

the Abercrombie & Fitch Co. Nonqualified Savings and Supplemental Retirement, composed of two

sub-plans (Plan I and Plan II). Plan I contains contributions made through December 31, 2004, while Plan

II contains contributions made on and after January 1, 2005. Participation in these plans is based on service

and compensation. The Company’s contributions are based on a percentage of associates’ eligible annual

compensation. The cost of the Company’s contributions to these plans was $16.4 million in Fiscal 2011,

$19.4 million in Fiscal 2010 and $17.8 million in Fiscal 2009.

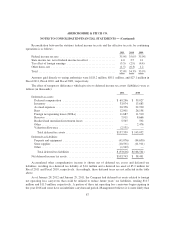

Effective February 2, 2003, the Company established a Chief Executive Officer Supplemental

Executive Retirement Plan (the “SERP”) to provide additional retirement income to its Chairman and Chief

Executive Officer (“CEO”). Subject to service requirements, the CEO will receive a monthly benefit equal

to 50% of his final average compensation (as defined in the SERP) for life. The final average compensation

used for the calculation is based on actual compensation, base salary and cash incentive compensation,

averaged over the last 36 consecutive full calendar months ending before the CEO’s retirement. The

Company recorded net expense of $1.3 million and $2.7 million for Fiscal 2011 and Fiscal 2010,

respectively, and net income of $1.0 million for Fiscal 2009, associated with the SERP.

The expense for the fifty-two weeks ended January 29, 2011, included an expense of $2.1 million to

correct a cumulative under accrual of the SERP relating to prior periods, primarily Fiscal 2008. The

Company does not believe this correction was material to the periods affected.

94