Abercrombie & Fitch 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Investment Securities

The Company maintains its cash equivalents in financial instruments, primarily money market funds

and United States treasury bills, with original maturities of three months or less.

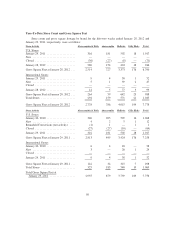

The Company also holds investments in investment grade auction rate securities (“ARS”) that have

maturities ranging from 16 to 31 years. The par and carrying values, and related cumulative other-than-

temporary impairment charges for the Company’s available-for-sale marketable securities as of January 28,

2012 were as follows:

Par

Value

Other-than-

Temporary

Impairment

Carrying

Value

(in thousands)

Available-for-sale securities:

Auction rate securities — student loan backed ........ $ 92,975 $ (8,325) $84,650

Auction rate securities — municipal authority bonds . . . 19,975 (5,117) 14,858

Total available-for-sale securities ................ $112,950 $(13,442) $99,508

As of January 28, 2012, approximately 46% of the Company’s ARS were “AAA” rated, approximately

16% of the Company’s ARS were “AA” rated, and approximately 38% of the Company’s ARS were “A–”

rated, in each case as rated by one or more of the major credit rating agencies. The ratings take into account

insurance policies guaranteeing both the principal and accrued interest. Each investment in student loans is

insured by (1) the U.S. government under the Federal Family Education Loan Program, (2) a private insurer

or (3) a combination of both. The percentage of insurance coverage of the outstanding principal and interest of

the ARS varies by security. The credit ratings may change over time and would be an indicator of the default

risk associated with the ARS and could have a material effect on the value of the ARS.

During the fifty-two weeks ended January 28, 2012, the Company changed its intent regarding the sale

of its ARS, resulting in recognition of an other-than-temporary impairment of $13.4 million recognized in

other expense.

The irrevocable rabbi trust (the “Rabbi Trust”) is intended to be used as a source of funds to match

respective funding obligations to participants in the Abercrombie & Fitch Co. Nonqualified Savings and

Supplemental Retirement Plan I, the Abercrombie & Fitch Co. Nonqualified Savings and Supplemental

Retirement Plan II and the Chief Executive Officer Supplemental Executive Retirement Plan. As of

January 28, 2012, total assets held in the Rabbi Trust were $85.1 million and related to trust-owned life

insurance policies with a cash surrender value of $85.1 million and an immaterial amount of assets held in

money market funds. The trust-owned life insurance policies are recorded at cash surrender value, in Other

Assets on the Consolidated Balance Sheet and are restricted as to their use as noted above. Net realized and

unrealized gains or losses related to the municipal notes and bonds held in the Rabbi Trust were not material

for the fifty-two weeks ended January 28, 2012 and January 29, 2011. The change in cash surrender value of

the trust-owned life insurance policies held in the Rabbi Trust resulted in realized gains of $2.5 million and

$2.3 million for the fifty-two weeks ended January 28, 2012 and January 29, 2011, respectively.

Interest Rate Risks

As of January 28, 2012, the Company had no long-term debt outstanding under the Amended and

Restated Credit Agreement.

58