Abercrombie & Fitch 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

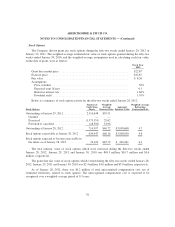

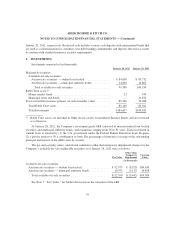

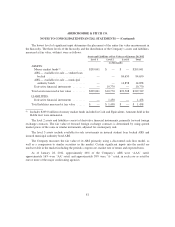

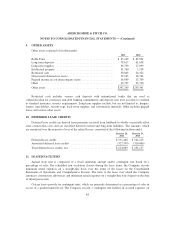

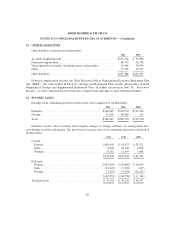

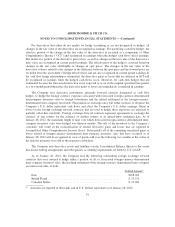

9. OTHER ASSETS

Other assets consisted of (in thousands):

2011 2010

Rabbi Trust ............................................... $ 85,149 $ 82,501

Long-term deposits ......................................... 78,617 61,658

Long-term supplies ......................................... 36,739 27,099

Intellectual property ......................................... 31,760 7,558

Restricted cash ............................................. 30,043 26,322

Non-current deferred tax assets ................................ 29,165 16,764

Prepaid income tax on intercompany items ....................... 16,049 13,709

Other .................................................... 39,727 23,730

Other assets ............................................... $347,249 $259,341

Restricted cash includes various cash deposits with international banks that are used as

collateralization for customary non-debt banking commitments and deposits into trust accounts to conform

to standard insurance security requirements. Long-term supplies include, but are not limited to, hangers,

frames, sign holders, security tags, back-room supplies, and construction materials. Other includes prepaid

leases and various other assets.

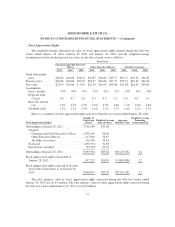

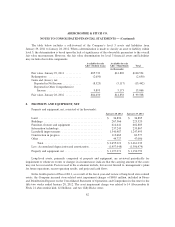

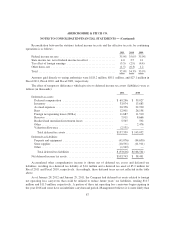

10. DEFERRED LEASE CREDITS

Deferred lease credits are derived from payments received from landlords to wholly or partially offset

store construction costs and are classified between current and long-term liabilities. The amounts, which

are amortized over the respective lives of the related leases, consisted of the following (in thousands):

January 28,

2012

January 29,

2011

Deferred lease credits ...................................... $551,468 $ 544,223

Amortized deferred lease credits ............................. (327,399) (310,066)

Total deferred lease credits, net .............................. $224,069 $ 234,157

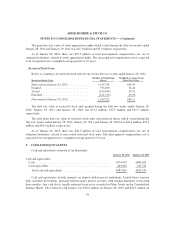

11. LEASED FACILITIES

Annual store rent is comprised of a fixed minimum amount and/or contingent rent based on a

percentage of sales. For scheduled rent escalation clauses during the lease terms, the Company records

minimum rental expenses on a straight-line basis over the terms of the leases on the Consolidated

Statements of Operations and Comprehensive Income. The term of the lease over which the Company

amortizes construction allowances and minimum rental expenses on a straight-line basis begins on the date

of initial possession.

Certain leases provide for contingent rents, which are primarily determined as a percentage of sales in

excess of a predetermined level. The Company records a contingent rent liability in accrued expenses on

84