Abercrombie & Fitch 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

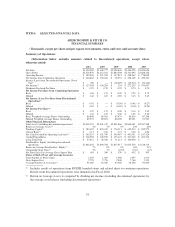

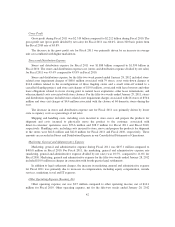

Gross Profit

Gross profit during Fiscal 2011 was $2.519 billion compared to $2.212 billion during Fiscal 2010. The

gross profit rate (gross profit divided by net sales) for Fiscal 2011 was 60.6%, down 320 basis points from

the Fiscal 2010 rate of 63.8%.

The decrease in the gross profit rate for Fiscal 2011 was primarily driven by an increase in average

unit cost combined with higher markdowns.

Stores and Distribution Expense

Stores and distribution expense for Fiscal 2011 was $1.888 billion compared to $1.590 billion in

Fiscal 2010. The stores and distribution expense rate (stores and distribution expense divided by net sales)

for Fiscal 2011 was 45.4% compared to 45.8% in Fiscal 2010.

Stores and distribution expense for the fifty-two week period ended January 28, 2012 included store-

related asset impairment charges of $68.0 million associated with 79 stores, asset write-down charges of

$14.6 million related to the reconfiguration of three flagship stores and a small write-off related to a

cancelled flagship project, and store exit charges of $19.0 million, associated with lease buyouts and other

lease obligations related to stores closing prior to natural lease expirations, other lease terminations, and

other incidental costs associated with store closures. For the fifty-two weeks ended January 29, 2011, stores

and distribution expense included store-related asset impairment charges associated with 26 stores of $50.6

million and store exit charges of $4.4 million associated with the closure of 64 domestic stores during the

year.

The decrease in stores and distribution expense rate for Fiscal 2011 was primarily driven by lower

store occupancy costs as a percentage of net sales.

Shipping and handling costs, including costs incurred to store, move and prepare the products for

shipment and costs incurred to physically move the product to the customer, associated with

direct-to-consumer operations were $53.6 million and $38.9 million for Fiscal 2011 and Fiscal 2010,

respectively. Handling costs, including costs incurred to store, move and prepare the products for shipment

to the stores were $62.8 million and $42.8 million for Fiscal 2011 and Fiscal 2010, respectively. These

amounts are recorded in Stores and Distribution Expense in our Consolidated Statements of Operations.

Marketing, General and Administrative Expense

Marketing, general and administrative expense during Fiscal 2011 was $437.1 million compared to

$400.8 million in Fiscal 2010. For Fiscal 2011, the marketing, general and administrative expense rate

(marketing, general and administrative expense divided by net sales) was 10.5%, compared to 11.6% for

Fiscal 2010. Marketing, general and administrative expense for the fifty-two weeks ended January 28, 2012

included $10.0 million in charges in connection with fourth quarter legal settlements.

In addition to legal settlement charges, the increase in marketing, general and administrative expense

for Fiscal 2011 was primarily due to increases in compensation, including equity compensation, outside

services, marketing, travel and IT expenses.

Other Operating Expense (Income), Net

Other operating expense, net was $3.5 million compared to other operating income, net of $10.1

million for Fiscal 2010. Other operating expense, net for the fifty-two weeks ended January 28, 2012

42