Abercrombie & Fitch 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

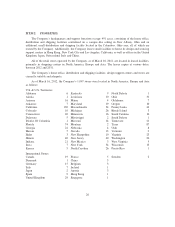

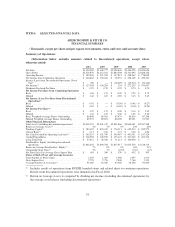

ITEM 6. SELECTED FINANCIAL DATA.

ABERCROMBIE & FITCH CO.

FINANCIAL SUMMARY

(Thousands, except per share and per square foot amounts, ratios and store and associate data)

Summary of Operations

(Information below excludes amounts related to discontinued operations, except where

otherwise noted)

2011 2010 2009 2008 2007

Net Sales .................................... $4,158,058 $3,468,777 $2,928,626 $3,484,058 $3,699,656

Gross Profit .................................. $2,518,870 $2,212,181 $1,883,598 $2,331,095 $2,488,166

Operating Income ............................. $ 190,030 $ 231,932 $ 117,912 $ 498,262 $ 778,909

Net Income from Continuing Operations ........... $ 126,862 $ 150,283 $ 78,953 $ 308,169 $ 499,127

Income (Loss) from Discontinued Operations, Net of

Tax(1) ..................................... $ 796 $ — $ (78,699) $ (35,914) $ (23,430)

Net Income(1) ................................. $ 127,658 $ 150,283 $ 254 $ 272,255 $ 475,697

Dividends Declared Per Share ................... $ 0.70 $ 0.70 $ 0.70 $ 0.70 $ 0.70

Net Income Per Share from Continuing Operations

Basic ....................................... $ 1.46 $ 1.71 $ 0.90 $ 3.55 $ 5.72

Diluted ..................................... $ 1.42 $ 1.67 $ 0.89 $ 3.45 $ 5.45

Net Income (Loss) Per Share from Discontinued

Operations(1)

Basic ....................................... $ 0.01 $ — $ (0.90) $ (0.41) $ (0.27)

Diluted ..................................... $ 0.01 $ — $ (0.89) $ (0.40) $ (0.26)

Net Income Per Share(1)

Basic ....................................... $ 1.47 $ 1.71 $ 0.00 $ 3.14 $ 5.45

Diluted ..................................... $ 1.43 $ 1.67 $ 0.00 $ 3.05 $ 5.20

Basic Weighted-Average Shares Outstanding ....... 86,848 88,061 87,874 86,816 87,248

Diluted Weighted-Average Shares Outstanding ...... 89,537 89,851 88,609 89,291 91,523

Other Financial Information

Total Assets (including discontinued operations) ..... $3,048,153 $2,941,415 $2,821,866 $2,848,181 $2,567,598

Return on Average Assets(2) ..................... 4% 5% 0% 10% 20%

Working Capital(3) ............................. $ 783,422 $ 874,417 $ 776,311 $ 622,213 $ 585,575

Current Ratio(4) ............................... $ 2.11 $ 2.56 $ 2.73 $ 2.38 $ 2.08

Net Cash Provided by Operating Activities(1) ........ $ 365,219 $ 391,789 $ 395,487 $ 491,031 $ 817,524

Capital Expenditures ........................... $ 318,598 $ 160,935 $ 175,472 $ 367,602 $ 403,345

Long-Term Debt .............................. $ 57,851 $ 68,566 $ 71,213 $ 100,000 $ —

Stockholders’ Equity (including discontinued

operations) ................................ $1,862,456 $1,890,784 $1,827,917 $1,845,578 $1,618,313

Return on Average Stockholders’ Equity(5) .......... 7% 8% 0% 16% 31%

Comparable Store Sales(6) ....................... 5% 7% (23)% (13)% (1)%

Net Store Sales Per Average Gross Square Foot ..... $ 463 $ 390 $ 339 $ 432 $ 503

Stores at End of Year and Average Associates

Total Number of Stores Open .................... 1,045 1,069 1,096 1,097 1,013

Gross Square Feet ............................. 7,778 7,756 7,848 7,760 7,133

Average Number of Associates(7) ................. 91,000 83,000 83,000 96,200 94,600

(1) Includes results of operations from RUEHL branded stores and related direct-to-consumer operations.

Results from discontinued operations were immaterial in Fiscal 2010.

(2) Return on Average Assets is computed by dividing net income (including discontinued operations) by

the average asset balance (including discontinued operations).

34