Abercrombie & Fitch 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

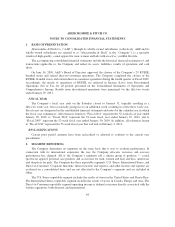

1. BASIS OF PRESENTATION

Abercrombie & Fitch Co. (“A&F”), through its wholly-owned subsidiaries (collectively, A&F and its

wholly-owned subsidiaries are referred to as “Abercrombie & Fitch” or the “Company”), is a specialty

retailer of high-quality, casual apparel for men, women and kids with an active, youthful lifestyle.

The accompanying consolidated financial statements include the historical financial statements of, and

transactions applicable to, the Company and reflect its assets, liabilities, results of operations and cash

flows.

On June 16, 2009, A&F’s Board of Directors approved the closure of the Company’s 29 RUEHL

branded stores and related direct-to-consumer operations. The Company completed the closure of the

RUEHL branded stores and related direct-to-consumer operations during the fourth quarter of Fiscal 2009.

Accordingly, the results of operations of RUEHL are reflected in Income (Loss) from Discontinued

Operations, Net of Tax for all periods presented on the Consolidated Statements of Operations and

Comprehensive Income. Results from discontinued operations were immaterial for the fifty-two weeks

ended January 29, 2011.

FISCAL YEAR

The Company’s fiscal year ends on the Saturday closest to January 31, typically resulting in a

fifty-two week year, but occasionally giving rise to an additional week, resulting in a fifty-three week year.

Fiscal years are designated in the consolidated financial statements and notes by the calendar year in which

the fiscal year commences. All references herein to “Fiscal 2011” represent the 52-week fiscal year ended

January 28, 2012; to “Fiscal 2010” represent the 52-week fiscal year ended January 29, 2011; and to

“Fiscal 2009” represent the 52-week fiscal year ended January 30, 2010. In addition, all references herein

to “Fiscal 2012” represent the 53-week fiscal year that will end on February 2, 2013.

RECLASSIFICATIONS

Certain prior period amounts have been reclassified or adjusted to conform to the current year

presentation.

2. SEGMENT REPORTING

The Company determines its segments on the same basis that it uses to evaluate performance. In

connection with its international expansion, the way the Company allocates resources and assesses

performance has changed. All of the Company’s segments sell a similar group of products — casual

sportswear apparel, personal care products and accessories for men, women and kids and bras, underwear

and sleepwear for girls. The Company has three reportable segments; U.S. Stores, International Stores, and

Direct-to-Consumer. Corporate functions, interest income and expense, and other income and expense are

evaluated on a consolidated basis and are not allocated to the Company’s segments and are included in

Other.

The U.S. Stores reportable segment includes the results of stores in the United States and Puerto Rico.

The International Stores reportable segment includes the results of stores in Canada, Europe and Asia. The

Direct-to-Consumer reportable segment operating income is defined as income directly associated with the

website operations, both domestic and international.

64