Abercrombie & Fitch 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

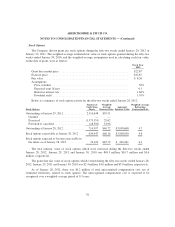

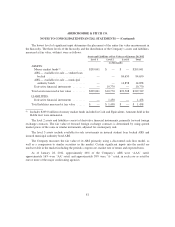

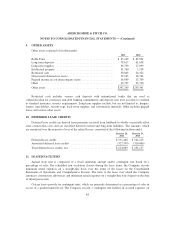

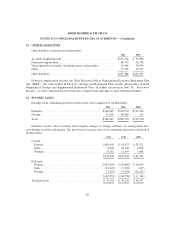

13. OTHER LIABILITIES

Other liabilities consisted of (in thousands):

2011 2010

Accrued straight-line rent .................................... $114,136 $ 95,838

Deferred compensation ...................................... 84,573 76,198

Unrecognized tax benefits, including interest and penalties .......... 19,496 20,994

Other .................................................... 17,143 10,537

Other liabilities ............................................ $235,348 $203,567

Deferred compensation includes the Chief Executive Officer Supplemental Executive Retirement Plan

(the “SERP”), the Abercrombie & Fitch Co. Savings and Retirement Plan and the Abercrombie & Fitch

Nonqualified Savings and Supplemental Retirement Plan, all further discussed in Note 18, “Retirement

Benefits,” as well as deferred Board of Directors compensation and other accrued retirement benefits.

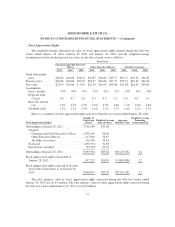

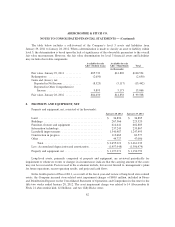

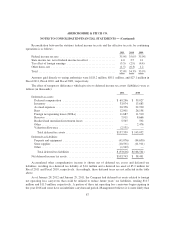

14. INCOME TAXES

Earnings from continuing operations before taxes were comprised of (in thousands):

2011 2010 2009

Domestic ....................................... $148,629 $190,570 $119,358

Foreign ........................................ 37,824 38,000 152

Total .......................................... $186,453 $228,570 $119,510

Domestic income above includes intercompany charges to foreign affiliates for management fees,

cost-sharing, royalties and interest. The provision for income taxes from continuing operations consisted of

(in thousands):

2011 2010 2009

Current:

Federal ....................................... $100,495 $ 94,922 $ 33,212

State ......................................... 11,085 16,126 4,003

Foreign ....................................... 13,262 11,395 5,086

$124,842 $122,443 $ 42,301

Deferred:

Federal ....................................... $(47,619) $ (32,669) $ 10,055

State ......................................... (10,007) (7,229) (147)

Foreign ....................................... (7,625) (4,258) (11,652)

$ (65,251) $ (44,156) $ (1,744)

Total provision .................................. $ 59,591 $ 78,287 $ 40,557

86