Abercrombie & Fitch 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

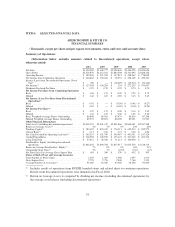

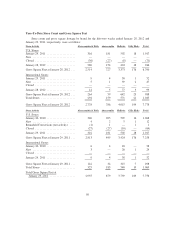

FISCAL 2010 COMPARED TO FISCAL 2009

Net Sales

Net sales for Fiscal 2010 were $3.469 billion, an increase of 18% from Fiscal 2009 net sales of $2.929

billion. The net sales increase was attributable to a 7% increase in comparable store sales, a 40% increase

in the direct-to-consumer business, including shipping and handling revenue, and new stores, primarily

international. The impact of foreign currency on sales for Fiscal 2010 and Fiscal 2009 was less than 1% of

net sales.

Total Company U.S. store sales for Fiscal 2010 were $2.547 billion, an increase of 7% from Fiscal

2009 sales of $2.378 billion. Total Company international store sales for Fiscal 2010 were $505.1 million,

an increase of 97% from Fiscal 2009 sales of $256.2 million.

Direct-to-consumer sales in Fiscal 2010, including shipping and handling revenue, were $405.0

million, an increase of 40% from Fiscal 2009 direct-to-consumer sales of $290.1 million. The

direct-to-consumer business, including shipping and handling revenue, accounted for 11.7% of total net

sales in Fiscal 2010 compared to 9.9% in Fiscal 2009.

Comparable store sales by brand for Fiscal 2010 were as follows: Abercrombie & Fitch increased 9%,

with women’s increasing by a high single digit percent and men’s increasing by a low double digit.

abercrombie kids increased 5%, with girls and guys each increasing by a mid single digit. Hollister

increased 6%, with bettys increasing by a mid single digit and dudes increasing by a high single digit.

On a comparable store sales basis, Europe was the strongest performing region, while Canada and

Japan were the weakest.

For Fiscal 2010, from a comparable store sales perspective across all brands, the masculine categories

out-paced the feminine categories. From a merchandise classification standpoint, woven shirts, fleece, and

outerwear were stronger performing categories for the male business while jeans and graphics were the

weaker performing categories. In the female business, woven shirts, dresses, and fleece were stronger

performing categories, while knit tops and jeans were weaker performing categories.

Gross Profit

Gross profit during Fiscal 2010 was $2.212 billion compared to $1.884 billion during Fiscal 2009. The

gross profit rate for Fiscal 2010 was 63.8%, down 50 basis points from the Fiscal 2009 rate of 64.3%.

The decrease in the gross profit rate for Fiscal 2010 was primarily driven by a 9% decrease in average

unit retail, which was partially offset by a reduction in average unit cost.

Stores and Distribution Expense

Stores and distribution expense for Fiscal 2010 was $1.590 billion compared to $1.426 billion in

Fiscal 2009. The stores and distribution expense rate for Fiscal 2010 was 45.8% compared to 48.7% in

Fiscal 2009.

Stores and distribution expense for the fifty-two week period ended January 29, 2011 included store-

related asset impairment charges associated with 26 stores of $50.6 million and store exit charges of $4.4

million associated with the closure of 64 domestic stores during the year. For the fifty-two weeks ended

January 30, 2010, stores and distribution expense included store-related asset impairment charges

associated with 99 stores of $33.2 million.

44