Abercrombie & Fitch 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

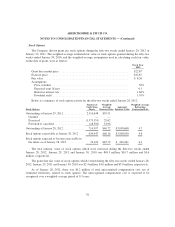

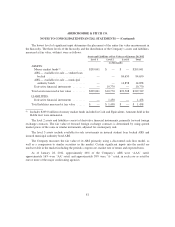

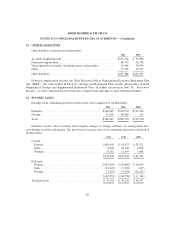

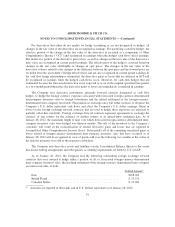

The table below includes a roll-forward of the Company’s level 3 assets and liabilities from

January 29, 2011 to January 28, 2012. When a determination is made to classify an asset or liability within

level 3, the determination is based upon the lack of significance of the observable parameters to the overall

fair value measurement. However, the fair value determination for level 3 financial assets and liabilities

may include observable components.

Available-for-sale

ARS - Student Loans

Available-for-sale

ARS - Muni Bonds Total

(in thousands)

Fair value, January 29, 2011 ........... $85,732 $14,802 $100,534

Redemptions ....................... (2,650) (2,650)

Gains and (losses), net:

Reported in Net Income ............. (8,325) (5,117) (13,442)

Reported in Other Comprehensive

Income ........................ 9,893 5,173 15,066

Fair value, January 28, 2012 ........... $84,650 $14,858 $ 99,508

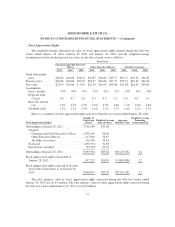

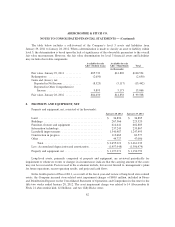

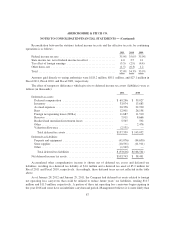

8. PROPERTY AND EQUIPMENT, NET

Property and equipment, net, consisted of (in thousands):

January 28, 2012 January 29, 2011

Land ............................................ $ 36,890 $ 36,885

Buildings ......................................... 267,566 223,520

Furniture, fixtures and equipment ...................... 614,641 602,885

Information technology .............................. 237,245 233,867

Leasehold improvements ............................ 1,340,487 1,247,493

Construction in progress ............................. 113,663 69,577

Other ............................................ 44,727 47,006

Total ........................................ $2,655,219 $ 2,461,233

Less: Accumulated depreciation and amortization ......... (1,457,948) (1,306,474)

Property and equipment, net .......................... $1,197,271 $ 1,154,759

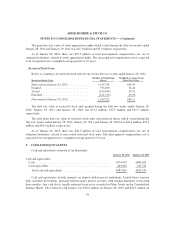

Long-lived assets, primarily comprised of property and equipment, are reviewed periodically for

impairment or whenever events or changes in circumstances indicate that the carrying amount of the assets

may not be recoverable. Factors used in the evaluation include, but are not limited to, management’s plans

for future operations, recent operating results, and projected cash flows.

In the fourth quarter of Fiscal 2011, as a result of the fiscal year-end review of long-lived store-related

assets, the Company incurred store-related asset impairment charges of $68.0 million, included in Stores

and Distribution Expense on the Consolidated Statement of Operations and Comprehensive Income for the

fifty-two weeks ended January 28, 2012. The asset impairment charge was related to 14 Abercrombie &

Fitch, 21 abercrombie kids, 42 Hollister, and two Gilly Hicks stores.

82