Abercrombie & Fitch 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The terms of the Amended and Restated Credit Agreement include customary events of default such

as payment defaults, cross-defaults to other material indebtedness, undischarged material judgments,

bankruptcy and insolvency, the occurrence of a defined change in control, or the failure to observe the

negative covenants and other covenants related to the operation and conduct of the business of A&F and its

subsidiaries. Upon an event of default, the lenders will not be obligated to make loans or other extensions

of credit and may, among other things, terminate their commitments to the Company, and declare any then

outstanding loans due and payable immediately.

The Amended and Restated Credit Agreement will mature on July 27, 2016. The Company had no

trade letters of credit outstanding at January 28, 2012 and January 29, 2011. Stand-by letters of credit

outstanding, under either the Amended and Restated Credit Agreement or Prior Credit Agreement as

applicable, on January 28, 2012 and January 29, 2011 were immaterial.

As of January 28, 2012, the Company did not have any borrowings under the Amended and Restated

Credit Agreement and had $43.8 million outstanding under the Prior Credit Agreement as of January 29,

2011. The amounts outstanding under the Prior Credit Agreement were denominated in Japanese Yen and

were fully repaid during the fifty-two weeks ended January 28, 2012.

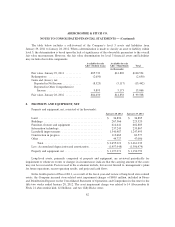

As of January 28, 2012 and January 29, 2011, the Company also had $57.9 million and $24.8 million,

respectively, of long-term debt related to the landlord financing obligation for certain leases where the

Company is deemed the owner of the construction project for accounting purposes, as substantially all of

the risk of ownership during construction of a leased property is held by the Company. The landlord

financing obligation is amortized over the life of the related lease.

As of January 28, 2012, the carrying value of the Company’s long-term debt approximated fair value.

Total interest expense was $7.9 million and $7.8 million for the fifty-two weeks ended January 28, 2012

and January 29, 2011, respectively. The average interest rate for the long-term debt that had been

previously outstanding under the Prior Credit Agreement was 2.4% for the fifty-two weeks ended

January 28, 2012.

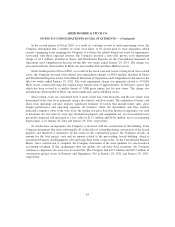

16. DERIVATIVES

The Company is exposed to risks associated with changes in foreign currency exchange rates and uses

derivatives, primarily forward contracts, to manage the financial impacts of these exposures. The Company

does not use forward contracts to engage in currency speculation and does not enter into derivative

financial instruments for trading purposes.

In order to qualify for hedge accounting treatment, a derivative must be considered highly effective at

offsetting changes in either the hedged item’s cash flows or fair value. Additionally, the hedge relationship

must be documented to include the risk management objective and strategy, the hedging instrument, the

hedged item, the risk exposure, and how hedge effectiveness will be assessed prospectively and

retrospectively. The extent to which a hedging instrument has been, and is expected to continue to be,

effective at achieving offsetting changes in fair value or cash flows is assessed and documented at least

quarterly. Any hedge ineffectiveness is reported in current period earnings and hedge accounting is

discontinued if it is determined that the derivative is not highly effective.

90