Abercrombie & Fitch 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

January 29, 2011, respectively. Restricted cash includes various cash deposits with international banks that

are used as collateralization for customary non-debt banking commitments and deposits into trust accounts

to conform with standard insurance security requirements.

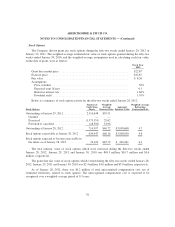

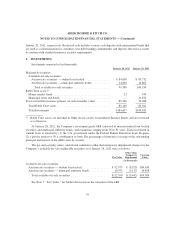

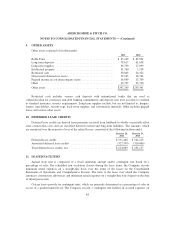

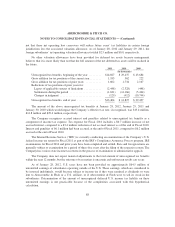

6. INVESTMENTS

Investments consisted of (in thousands):

January 28, 2012 January 29, 2011

Marketable securities:

Available-for-sale securities:

Auction rate securities — student loan backed ................. $ 84,650 $ 85,732

Auction rate securities — municipal authority bonds ............ 14,858 14,802

Total available-for-sale securities ......................... 99,508 100,534

Rabbi Trust assets:(1)

Money market funds ....................................... 23 343

Municipal notes and bonds .................................. — 11,870

Trust-owned life insurance policies (at cash surrender value) ......... 85,126 70,288

Total Rabbi Trust assets ..................................... 85,149 82,501

Total Investments .......................................... $184,657 $183,035

(1) Rabbi Trust assets are included in Other Assets on the Consolidated Balance Sheets and are restricted

as to their use.

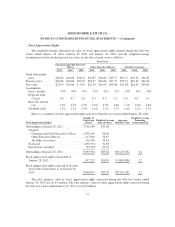

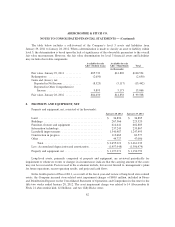

At January 28, 2012, the Company’s investment grade ARS consisted of insured student loan backed

securities and municipal authority bonds, with maturities ranging from 16 to 31 years. Each investment in

student loans is insured by (1) the U.S. government under the Federal Family Education Loan Program,

(2) a private insurer or (3) a combination of both. The percentage of insurance coverage of the outstanding

principal and interest of the ARS varies by security.

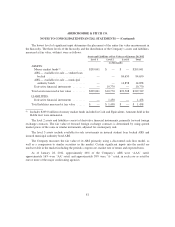

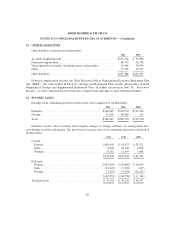

The par and carrying values, and related cumulative other-than-temporary impairment charges for the

Company’s available-for-sale marketable securities as of January 28, 2012 were as follows:

Par Value

Other-than-

Temporary

Impairment

Carrying

Value

(in thousands)

Available-for-sale securities:

Auction rate securities — student loan backed ................... $ 92,975 $ (8,325) $84,650

Auction rate securities — municipal authority bonds .............. 19,975 (5,117) 14,858

Total available-for-sale securities ........................... $112,950 $(13,442) $99,508

See Note 7, “Fair Value,” for further discussion on the valuation of the ARS.

79