Abercrombie & Fitch 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

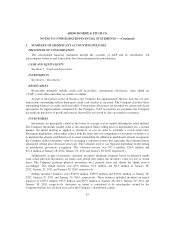

The Company is not required by law to escheat the value of unredeemed gift cards to the states in

which it operates. During Fiscal 2011, Fiscal 2010 and Fiscal 2009, the Company recognized other

operating income for gift card breakage of $7.2 million, $7.8 million and $9.0 million, respectively.

The Company does not include tax amounts collected as part of the sales transaction in its net sales

results.

COST OF GOODS SOLD

Cost of goods sold is primarily comprised of: cost incurred to produce inventory for sale, including

product costs, freight, import cost, as well as changes in reserves for shrink and valuation reserves. Gains

and losses associated with foreign currency exchange contracts related to hedging of inventory purchases

are also recognized in cost of goods sold when the inventory being hedged is sold.

STORES AND DISTRIBUTION EXPENSE

Stores and distribution expense includes store payroll, store management, rent, utilities and other

landlord expenses, depreciation and amortization, repairs and maintenance and other store support

functions, as well as Direct-to-Consumer expense and Distribution Center (“DC”) expense.

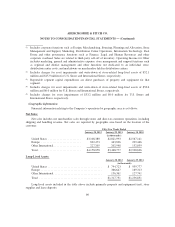

Shipping and handling costs, including costs incurred to store, move and prepare products for

shipment, and costs incurred to physically move the product to the customer, associated with

direct-to-consumer operations were $53.6 million, $38.9 million and $30.7 million for Fiscal 2011, Fiscal

2010 and Fiscal 2009, respectively. Handling costs, including costs incurred to store, move and prepare the

products for shipment to the stores were $62.8 million, $42.8 million and $34.1 million for Fiscal 2011,

Fiscal 2010 and Fiscal 2009, respectively. These amounts are recorded in Stores and Distribution Expense

in our Consolidated Statement of Operations. Costs incurred to physically move the product to the stores is

recorded in Cost of Goods Sold in our Consolidated Statement of Operations.

MARKETING, GENERAL & ADMINISTRATIVE EXPENSE

Marketing, general and administrative expense includes photography and media ads; store marketing;

home office compensation, except for those departments included in stores and distribution expense;

information technology; outside services such as legal and consulting; relocation; recruiting; samples and

travel expenses.

OTHER OPERATING EXPENSE (INCOME), NET

Other operating expense (income) consists primarily of the following: income related to gift card

balances whose likelihood of redemption has been determined to be remote; gains and losses on foreign

currency transactions; and the net impact of the change in valuation related to other-than-temporary

impairments associated with ARS. See Note 6, “Investments.”

WEBSITE AND ADVERTISING COSTS

Website and advertising costs are expensed as incurred as a component of Stores and Distribution

Expense on the Consolidated Statements of Operations and Comprehensive Income.

71