Abercrombie & Fitch 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

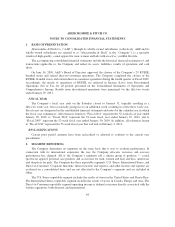

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

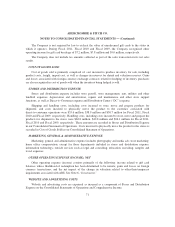

(1) Includes corporate functions such as Design, Merchandising, Sourcing, Planning and Allocation, Store

Management and Support, Marketing, Distribution Center Operations, Information Technology, Real

Estate and other governance functions such as Finance, Legal and Human Resources and other

corporate overhead. Sales are related to third-party sell-off of inventory. Operating Income for Other

includes marketing, general and administrative expense; store management and support functions such

as regional and district management and other functions not dedicated to an individual store;

distribution center costs; and markdowns on merchandise held in distribution centers.

(2) Includes charges for asset impairments and write-down of store-related long-lived assets of $52.1

million and $15.9 million for U.S. Stores and International Stores, respectively.

(3) Reportable segment capital expenditures are direct purchases of property and equipment for that

segment.

(4) Includes charges for asset impairments and write-down of store-related long-lived assets of $50.6

million and $0.0 million for U.S. Stores and International Stores, respectively.

(5) Includes charges for asset impairments of $33.2 million and $0.0 million for U.S. Stores and

International Stores, respectively.

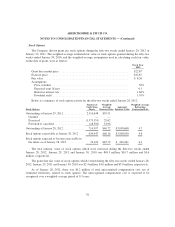

Geographic Information

Financial information relating to the Company’s operations by geographic area is as follows:

Net Sales:

Net sales includes net merchandise sales through stores and direct-to-consumer operations, including

shipping and handling revenue. Net sales are reported by geographic area based on the location of the

customer.

Fifty-Two Weeks Ended

January 28, 2012 January 29, 2011 January 30, 2010

(in thousands):

United States ....................... $3,108,380 $2,821,993 $2,567,141

Europe ............................ 822,473 443,836 229,446

Other International ................... 227,205 202,948 132,039

Total .............................. $4,158,058 $3,468,777 $2,928,626

Long-Lived Assets:

January 28, 2012 January 29, 2011

(in thousands):

United States ...................................... $ 794,723 $ 959,777

Europe ........................................... 366,647 169,313

Other International ................................. 156,361 127,741

Total ............................................ $1,317,731 $1,256,831

Long-lived assets included in the table above include primarily property and equipment (net), store

supplies and lease deposits.

66