Abercrombie & Fitch 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

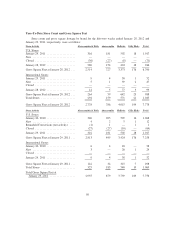

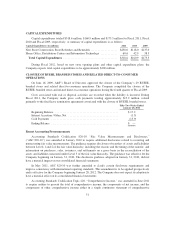

CAPITAL EXPENDITURES

Capital expenditures totaled $318.6 million, $160.9 million and $175.5 million for Fiscal 2011, Fiscal

2010 and Fiscal 2009, respectively. A summary of capital expenditures is as follows:

Capital Expenditures (in millions) 2011 2010 2009

New Store Construction, Store Refreshes and Remodels ................... $258.0 $118.0 $137.0

Home Office, Distribution Centers and Information Technology ............ 60.6 42.9 38.5

Total Capital Expenditures ...................................... $318.6 $160.9 $175.5

During Fiscal 2012, based on new store opening plans and other capital expenditure plans, the

Company expects total capital expenditures to be approximately $400 million.

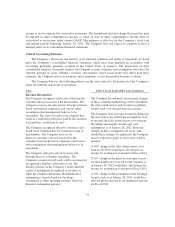

CLOSURE OF RUEHL BRANDED STORES AND RELATED DIRECT-TO-CONSUMER

OPERATIONS

On June 16, 2009, A&F’s Board of Directors approved the closure of the Company’s 29 RUEHL

branded stores and related direct-to-consumer operations. The Company completed the closure of the

RUEHL branded stores and related direct-to-consumer operations during the fourth quarter of Fiscal 2009.

Costs associated with exit or disposal activities are recorded when the liability is incurred. During

Fiscal 2011, the Company made gross cash payments totaling approximately $15.9 million, related

primarily to the final lease termination agreements associated with the closure of RUEHL branded stores.

Fifty-Two Weeks Ended

January 28, 2012

Beginning Balance ............................................ $17.2

Interest Accretion / Other, Net ................................... (1.3)

Cash Payments ............................................... (15.9)

Ending Balance ............................................... $ —

Recent Accounting Pronouncements

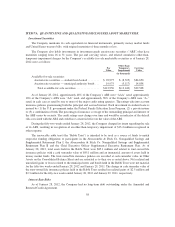

Accounting Standards Codification 820-10 “Fair Value Measurements and Disclosures,”

(“ASC 820-10”) was amended in January 2010 to require additional disclosures related to recurring and

nonrecurring fair value measurements. The guidance requires disclosure of transfers of assets and liabilities

between Levels 1 and 2 of the fair value hierarchy, including the reasons and the timing of the transfer; and

information on purchases, sales, issuances, and settlements on a gross basis in the reconciliation of the

assets and liabilities measured under Level 3 of the fair value hierarchy. The guidance was effective for the

Company beginning on January 31, 2010. The disclosure guidance adopted on January 31, 2010, did not

have a material impact on our consolidated financial statements.

In May 2011, ASC 820-10 was further amended to clarify certain disclosure requirements and

improve consistency with international reporting standards. This amendment is to be applied prospectively

and is effective for the Company beginning January 28, 2012. The Company does not expect its adoption to

have a material effect on its consolidated financial statements.

Accounting Standards Codification Topic 220, “Comprehensive Income,” was amended in June 2011

to require entities to present the total of comprehensive income, the components of net income, and the

components of other comprehensive income either in a single continuous statement of comprehensive

51