Abercrombie & Fitch 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ABERCROMBIE & FITCH CO.

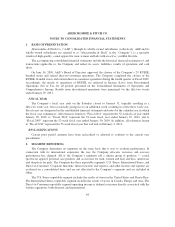

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

PRINCIPLES OF CONSOLIDATION

The consolidated financial statements include the accounts of A&F and its subsidiaries. All

intercompany balances and transactions have been eliminated in consolidation.

CASH AND EQUIVALENTS

See Note 5, “Cash and Equivalents.”

INVESTMENTS

See Note 6, “Investments.”

RECEIVABLES

Receivables primarily include credit card receivables, construction allowances, value added tax

(“VAT”) receivables and other tax credits or refunds.

As part of the normal course of business, the Company has approximately three to four days of sales

transactions outstanding with its third-party credit card vendors at any point. The Company classifies these

outstanding balances as credit card receivables. Construction allowances are recorded for certain store lease

agreements for improvements completed by the Company. VAT receivables are payments the Company

has made on purchases of goods and services that will be recovered as sales are made to customers.

INVENTORIES

Inventories are principally valued at the lower of average cost or market utilizing the retail method.

The Company determines market value as the anticipated future selling price of merchandise less a normal

margin. An initial markup is applied to inventory at cost in order to establish a cost-to-retail ratio.

Permanent markdowns, when taken, reduce both the retail and cost components of inventory on hand so as

to maintain the already established cost-to-retail relationship. In addition to markdowns already recognized,

the Company reduces inventory value by recording a valuation reserve that represents the estimated future

anticipated selling price decreases necessary. The valuation reserve can fluctuate depending on the timing

of markdowns previously recognized. The valuation reserve was $72.3 million, $24.4 million and

$11.4 million at January 28, 2012, January 29, 2011 and January 30, 2010, respectively.

Additionally, as part of inventory valuation, inventory shrinkage estimates based on historical trends

from actual physical inventories are made each period that reduce the inventory value for lost or stolen

items. The Company performs physical inventories on a periodic basis and adjusts the shrink reserve

accordingly. The shrink reserve was $9.3 million, $7.6 million and $8.1 million at January 28,

2012, January 29, 2011 and January 30, 2010, respectively.

Ending inventory balances were $569.8 million, $385.9 million and $310.6 million at January 28,

2012, January 29, 2011 and January 30, 2010, respectively. These balances included inventory in transit

balances of $103.1 million, $55.0 million and $39.9 million at January 28, 2012, January 29, 2011 and

January 30, 2010, respectively. Inventory in transit is considered to be merchandise owned by the

Company that has not yet been received at the Company’s distribution centers.

67