Abercrombie & Fitch 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

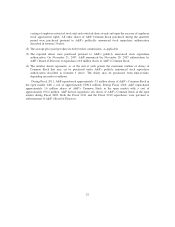

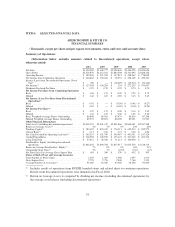

The Company believes that the non-GAAP financial measures are useful to investors as they provide

the ability to measure the Company’s operating performance and compare it against that of prior periods

without reference to the Consolidated Statements of Operations and Comprehensive Income impact of

non-cash, store-related asset impairment charges, charges related to store closures and lease exits, and other

charges associated with legal settlements during the fiscal year and a change in intent regarding the

Company’s ARS. These non-GAAP financial measures should not be used as alternatives to net income per

diluted share or as indicators of the ongoing operating performance of the Company and are also not

intended to supersede or replace the Company’s GAAP financial measures. The table below reconciles the

GAAP financial measures to the non-GAAP financial measures discussed above.

Fifty-Two Weeks Ended

January 28, 2012 January 29, 2011

Net income per diluted share from continuing operations on

a GAAP basis ................................... $1.42 $1.67

Plus: Asset impairment charges(1) .................... 0.49 0.34

Plus: Asset write-downs(2) .......................... 0.10 —

Plus: Store closure and lease exit charges(3) ............ 0.13 0.03

Plus: Legal charges(4) ............................. 0.07 —

Plus: ARS charges(5) .............................. 0.09 —

Net income per diluted share from continuing operations on

a non-GAAP basis ............................... $2.30 $2.05

Plus: Net income from discontinued operations ........ 0.01 —

Net income per diluted share on a non-GAAP basis ....... $2.31 $2.05

(1) The store-related asset impairment charges relate to stores whose asset carrying value exceeded their

fair value. For the fifty-two week period ended January 28, 2012, the charge was associated with

14 Abercrombie & Fitch, 21 abercrombie kids, 42 Hollister and two Gilly Hicks stores. For the

fifty-two week period ended January 29, 2011, the charge was associated with two Abercrombie &

Fitch, two abercrombie kids, nine Hollister and 13 Gilly Hicks stores.

(2) For the fifty-two week period ended January 28, 2012, the charge associated with the asset write-downs

was related to the reconfiguration of three flagship stores and a small write-off related to a cancelled

flagship project.

(3) For the fifty-two week periods ended January 28, 2012 and January 29, 2011, the charges for store

closures and lease exits were associated with lease buyouts and other lease obligations related to stores

closing prior to natural lease expirations, other lease terminations, and other incidental costs associated

with store closures.

(4) For the fifty-two week period ended January 28, 2012, the charge was related to legal settlements

during the fourth quarter.

(5) For the fifty-two week period ended January 28, 2012, the charge associated with the ARS was related

to a change in intent with regard to the Company’s auction rate securities portfolio, which resulted in

recognition of an other-than-temporary impairment.

Net cash provided by operating activities, the Company’s primary source of liquidity, was

$365.2 million for Fiscal 2011. This source of cash was primarily driven by results from operations,

adjusted for non-cash items, an increase in accounts payable and accrued expenses partially offset by

increases in inventory. The Company used $318.6 million of cash for capital expenditures. The Company

37