Abercrombie & Fitch 2011 Annual Report Download - page 75

Download and view the complete annual report

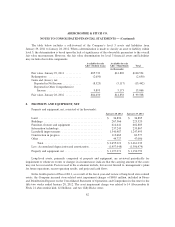

Please find page 75 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

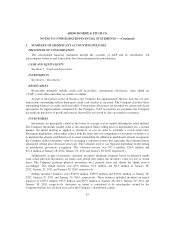

LEASES

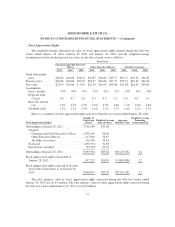

The Company leases property for its stores under operating leases. Lease agreements may contain

construction allowances, rent escalation clauses and/or contingent rent provisions.

For construction allowances, the Company records a deferred lease credit on the Consolidated Balance

Sheets and amortizes the deferred lease credit as a reduction of rent expense on the Consolidated

Statements of Operations and Comprehensive Income over the terms of the leases.

For scheduled rent escalation clauses during the lease terms, the Company records minimum rental

expense on a straight-line basis over the terms of the leases on the Consolidated Statements of Operations

and Comprehensive Income. The difference between the rent expense and the amount payable under the

lease is included in Accrued Expenses and Other Liabilities on the Consolidated Balance Sheets. The term

of the lease over which the Company amortizes construction allowances and minimum rental expenses on a

straight-line basis begins on the date of initial possession, which is generally when the Company enters the

space and begins construction.

Certain leases provide for contingent rents, which are determined as a percentage of gross sales. The

Company records a contingent rent liability in accrued expenses on the Consolidated Balance Sheets, and

the corresponding rent expense on the Consolidated Statements of Operations and Comprehensive Income

when management determines that achieving the specified levels during the fiscal year is probable. In

addition, most of the leases require payment of real estate taxes, insurance and certain common area

maintenance costs in addition to the future minimum lease payments.

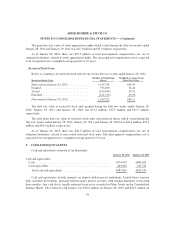

In certain lease arrangements, the Company is involved with the construction of the building. If the

Company determines that it has substantially all of the risks of ownership during construction of the leased

property and therefore is deemed to be the owner of the construction project, the Company records an asset

and related financing obligation for the amount of the total project costs and an amount related to the

pre-existing, leased building, which is included in Property and Equipment, Net and Long-Term Debt,

respectively, on the Consolidated Balance Sheets. Once construction is complete, the Company determines if

the asset qualifies for sale-leaseback accounting treatment. If the arrangement does not qualify for sale-lease

back treatment, the Company continues to amortize the obligation over the lease term and depreciates the

asset over its useful life. The Company does not report rent expense for the portion of the rent payment

determined to be related to the properties which are owned for accounting purposes. Rather, this portion of the

rental payments under the lease are recognized as a reduction of the financing obligation and interest expense.

The Company recorded a cumulative correction during the fourth quarter of Fiscal 2011 relating to

four specific leasing transactions to recognize approximately $33 million of long-lived assets and a

corresponding financing obligation in long-term debt. In connection with the cumulative correction during

the fourth quarter of Fiscal 2011, the Company reversed $1.2 million of previously recognized expense,

primarily rent expense, of which $1.1 million related to reversal of expense recognized during the first

three quarters of the current fiscal year. The Company does not believe the correction was material to any

current or prior interim or annual periods that were affected.

STORE PRE-OPENING EXPENSES

Pre-opening expenses related to new store openings are charged to operations as incurred.

72