Abercrombie & Fitch 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

DERIVATIVES

See Note 16, “Derivatives.”

CONTINGENCIES

In the normal course of business, the Company must make estimates of potential future legal

obligations and liabilities, which requires the use of management’s judgment on the outcome of various

issues. Management may also use outside legal advice to assist in the estimating process. However, the

ultimate outcome of various legal issues could be different than management estimates, and adjustments

may be required. See Note 19, “Contingencies,” for further discussion.

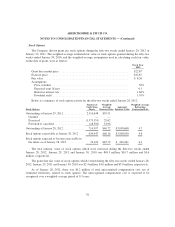

STOCKHOLDERS’ EQUITY

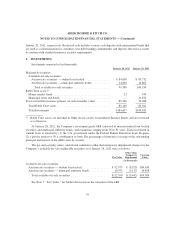

At January 28, 2012 and January 29, 2011, there were 150.0 million shares of A&F’s Class A

Common Stock, $0.01 par value, authorized, of which 85.6 million and 87.2 million shares were

outstanding at January 28, 2012 and January 29, 2011, respectively, and 106.4 million shares of Class B

Common Stock, $0.01 par value, authorized, none of which were outstanding at January 28, 2012 and

January 29, 2011. In addition, 15.0 million shares of A&F’s Preferred Stock, $0.01 par value, were

authorized, none of which have been issued. See Note 22, “Preferred Stock Purchase Rights” for

information about Preferred Stock Purchase Rights.

Holders of Class A Common Stock generally have identical rights to holders of Class B Common

Stock, except holders of Class A Common Stock are entitled to one vote per share while holders of Class B

Common Stock are entitled to three votes per share on all matters submitted to a vote of stockholders.

REVENUE RECOGNITION

The Company recognizes store sales at the time the customer takes possession of the merchandise.

Direct-to-consumer sales are recorded based on an estimated date for customer receipt of merchandise,

which is based on shipping terms and historical delivery terms. Amounts relating to shipping and handling

billed to customers in a sale transaction are classified as revenue and the related direct shipping and

handling costs are classified as Stores and Distribution Expense. Associate discounts are classified as a

reduction of net sales. The Company reserves for sales returns through estimates based on historical

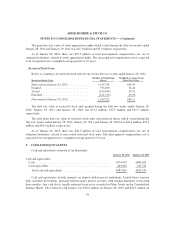

experience. The sales return reserve was $7.0 million, $10.3 million and $7.4 million at January 28,

2012, January 29, 2011 and January 30, 2010, respectively.

The Company sells gift cards in its stores and through direct-to-consumer operations. The Company

accounts for gift cards sold to customers by recognizing a liability at the time of sale. Gift cards sold to

customers do not expire or lose value over periods of inactivity. The liability remains on the Company’s

books until the Company recognizes income from gift cards. Income on gift cards is recognized at the

earlier of redemption by the customer (recognized as revenue) or when the Company determines that the

likelihood of redemption is remote, referred to as “gift card breakage” (recognized as other operating

income). The Company determines the probability of the gift card being redeemed to be remote based on

historical redemption patterns. At January 28, 2012 and January 29, 2011, the gift card liabilities on the

Company’s Consolidated Balance Sheets were $47.7 million and $47.1 million, respectively.

70