Abercrombie & Fitch 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

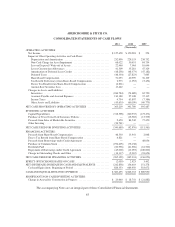

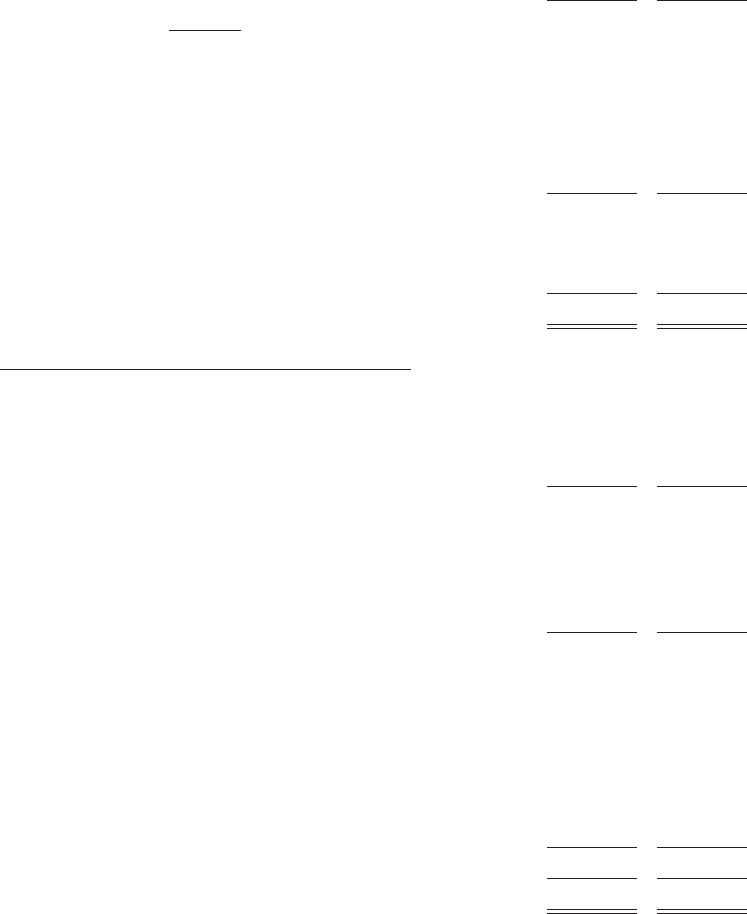

ABERCROMBIE & FITCH CO.

CONSOLIDATED BALANCE SHEETS

(Thousands, except par value amounts)

January 28,

2012

January 29,

2011

ASSETS

CURRENT ASSETS:

Cash and Equivalents ............................................. $ 583,495 $ 826,353

Marketable Securities ............................................ 84,650 —

Receivables .................................................... 89,350 74,777

Inventories ..................................................... 569,818 385,857

Deferred Income Taxes ........................................... 77,120 60,405

Other Current Assets ............................................. 84,342 79,389

TOTAL CURRENT ASSETS ........................................ 1,488,775 1,426,781

PROPERTY AND EQUIPMENT, NET ................................ 1,197,271 1,154,759

NON-CURRENT MARKETABLE SECURITIES ........................ 14,858 100,534

OTHER ASSETS .................................................. 347,249 259,341

TOTAL ASSETS .................................................. $3,048,153 $2,941,415

LIABILITIES AND STOCKHOLDERS’ EQUITY

CURRENT LIABILITIES:

Accounts Payable ................................................ $ 211,368 $ 137,235

Accrued Expenses ............................................... 375,020 300,100

Deferred Lease Credits ........................................... 41,047 41,538

Income Taxes Payable ............................................ 77,918 73,491

TOTAL CURRENT LIABILITIES .................................... 705,353 552,364

LONG-TERM LIABILITIES:

Deferred Income Taxes ........................................... 4,123 33,515

Deferred Lease Credits ........................................... 183,022 192,619

Long-Term Debt ................................................ 57,851 68,566

Other Liabilities ................................................. 235,348 203,567

TOTAL LONG-TERM LIABILITIES ................................. 480,344 498,267

STOCKHOLDERS’ EQUITY:

Class A Common Stock — $0.01 par value: 150,000 shares authorized and

103,300 shares issued at each of January 28, 2012 and January 29, 2011 . . 1,033 1,033

Paid-In Capital .................................................. 369,171 349,258

Retained Earnings ............................................... 2,320,571 2,272,317

Accumulated Other Comprehensive Income (Loss), net of tax ............ 6,455 (6,516)

Treasury Stock, at Average Cost — 17,662 and 16,054 shares at January 28,

2012 and January 29, 2011, respectively ............................ (834,774) (725,308)

TOTAL STOCKHOLDERS’ EQUITY ................................. 1,862,456 1,890,784

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY ................ $3,048,153 $2,941,415

The accompanying Notes are an integral part of these Consolidated Financial Statements.

61