Abercrombie & Fitch 2009 Annual Report Download - page 85

Download and view the complete annual report

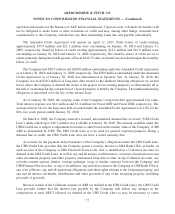

Please find page 85 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On September 16, 2005, a derivative action, styled The Booth Family Trust v. Michael S. Jeffries, et al.,

was filed in the United States District Court for the Southern District of Ohio, naming A&F as a nominal

defendant and seeking to assert claims for unspecified damages against nine of A&F’s present and former

directors, alleging various breaches of the directors’ fiduciary duty and seeking equitable and monetary relief.

In the following three months, four similar derivative actions were filed (three in the United States District

Court for the Southern District of Ohio and one in the Court of Common Pleas for Franklin County, Ohio)

against present and former directors of A&F alleging various breaches of the directors’ fiduciary duty

allegedly arising out of the same matters alleged in the Ross case and seeking equitable and monetary relief on

behalf of A&F. In March of 2006, the federal court derivative actions were consolidated with the Ross actions

for purposes of motion practice, discovery and pretrial proceedings. A consolidated amended derivative

complaint was filed in the federal proceeding on July 10, 2006. On February 16, 2007, A&F announced that

its Board of Directors had received a report of the Special Litigation Committee established by the Board to

investigate and act with respect to claims asserted in the derivative lawsuit, which concluded that there was no

evidence to support the asserted claims and directed the Company to seek dismissal of the derivative cases. On

September 10, 2007, the Company moved to dismiss the federal derivative cases on the authority of the

Special Litigation Committee report. On March 12, 2009, the Company’s motion was granted and, on

April 10, 2009, plaintiffs filed an appeal from the order of dismissal. The state court has stayed further

proceedings in the state-court derivative action until resolution of the consolidated federal derivative cases.

Management intends to defend the aforesaid matters vigorously, as appropriate. Management is unable

to quantify the potential exposure of the aforesaid matters. However, management’s assessment of the

Company’s current exposure could change in the event of the discovery of additional facts with respect to

legal matters pending against the Company or determinations by judges, juries, administrative agencies or

other finders of fact that are not in accordance with management’s evaluation of the claims.

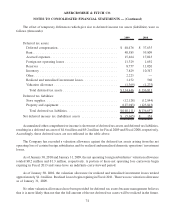

17. PREFERRED STOCK PURCHASE RIGHTS

On July 16, 1998, A&F’s Board of Directors declared a dividend of one Series A Participating

Cumulative Preferred Stock Purchase Right (the “Rights”) for each outstanding share of Class A Common

Stock (the “Common Stock”), par value $.01 per share, of A&F. The dividend was paid on July 28, 1998 to

stockholders of record on that date. Shares of Common Stock issued after July 28, 1998 and prior to May 25,

1999 were issued with one Right attached. A&F’s Board of Directors declared a two-for-one stock split (the

“Stock Split”) on the Common Stock, payable on June 15, 1999 to the holders of record at the close of

business on May 25, 1999. In connection with the Stock Split, the number of Rights associated with each

share of Common Stock outstanding as of the close of business on May 25, 1999, or issued or delivered after

May 25, 1999 and prior to the “Distribution Date” (as defined below), was proportionately adjusted from one

Right to 0.50 Right. Each share of Common Stock issued after May 25, 1999 and prior to the Distribution Date

has been, and will be issued, with 0.50 Right attached so that all shares of Common Stock outstanding prior to

the Distribution Date will have 0.50 Right attached.

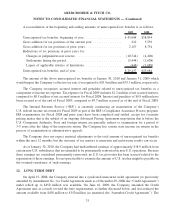

The Rights are initially attached to the shares of Common Stock. The Rights will separate from the

Common Stock after a Distribution Date occurs. The “Distribution Date” generally means the earlier of (i) the

close of business on the 10th day after the date (the “Share Acquisition Date”) of the first public

announcement that a person or group (other than A&F or any of A&F’s subsidiaries or any employee

84

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)