Abercrombie & Fitch 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

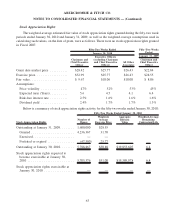

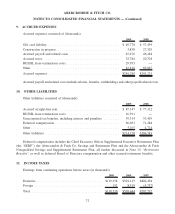

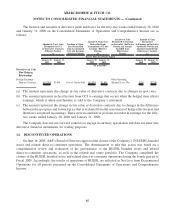

9. ACCRUED EXPENSES

Accrued expenses consisted of (thousands):

2009 2008

Gift card liability ........................................ $ 49,778 $ 57,459

Construction in progress ................................... 5,838 27,329

Accrued payroll and related costs ............................ 45,476 46,248

Accrued taxes........................................... 32,784 20,328

RUEHL lease termination costs.............................. 29,595 —

Other ................................................. 82,818 89,867

Accrued expenses ........................................ $246,289 $241,231

Accrued payroll and related costs include salaries, benefits, withholdings and other payroll related costs.

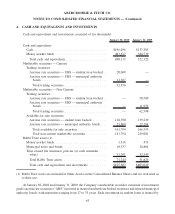

10. OTHER LIABILITIES

Other liabilities consisted of (thousands):

2009 2008

Accrued straight-line rent .................................. $ 87,147 $ 77,312

RUEHL lease termination costs.............................. 16,391 —

Unrecognized tax benefits, including interest and penalties ......... 39,314 53,419

Deferred compensation .................................... 66,053 71,288

Other ................................................. 5,265 4,724

Other liabilities ......................................... $214,170 $206,743

Deferred compensation includes the Chief Executive Officer Supplemental Executive Retirement Plan

(the “SERP”), the Abercrombie & Fitch Co. Savings and Retirement Plan and the Abercrombie & Fitch

Nonqualified Savings and Supplemental Retirement Plan, all further discussed in Note 15, “Retirement

Benefits”, as well as deferred Board of Directors compensation and other accrued retirement benefits.

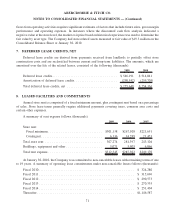

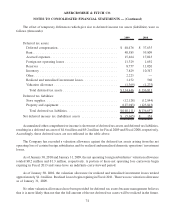

11. INCOME TAXES

Earnings from continuing operations before taxes (in thousands):

2009 2008 2007

Domestic..................................... $119,358 $501,125 $802,494

Foreign ...................................... 152 8,519 (4,757)

Total ........................................ $119,510 $509,644 $797,737

72

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)