Abercrombie & Fitch 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

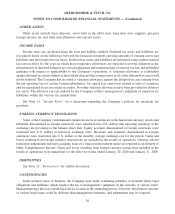

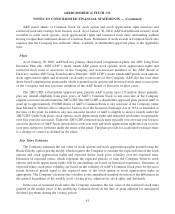

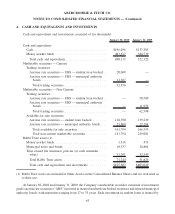

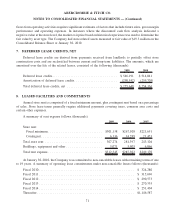

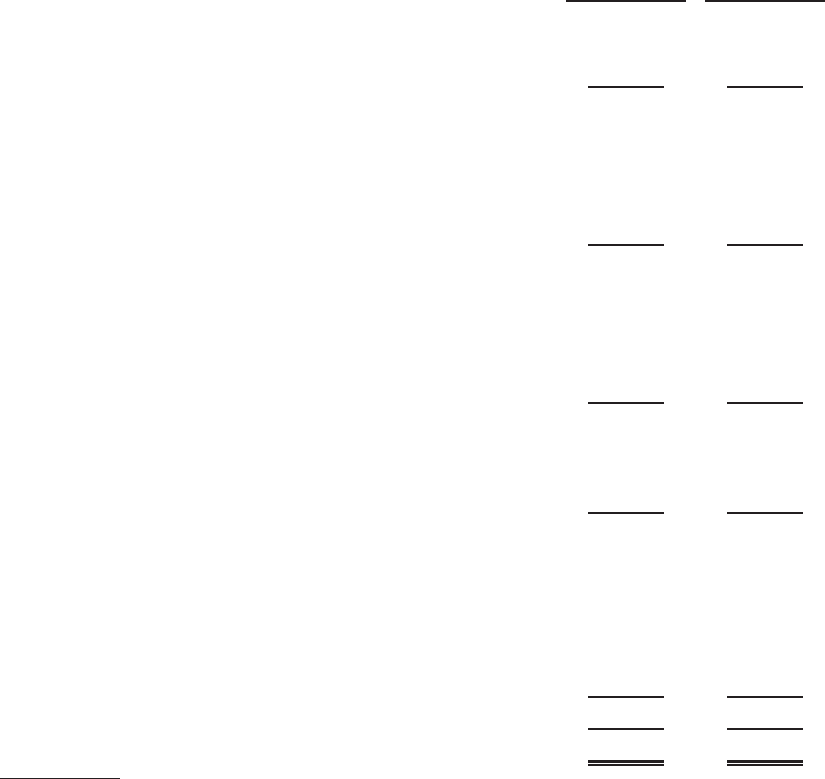

4. CASH AND EQUIVALENTS AND INVESTMENTS

Cash and equivalents and investments consisted of (in thousands):

January 30, 2010 January 31, 2009

Cash and equivalents:

Cash......................................... $196,496 $137,383

Money market funds ............................. 483,617 384,739

Total cash and equivalents ....................... 680,113 522,122

Marketable securities — Current:

Trading securities:

Auction rate securities — UBS — student loan backed . . 20,049 —

Auction rate securities — UBS — municipal authority

bonds . ................................... 12,307 —

Total trading securities........................ 32,356 —

Marketable securities — Non-Current:

Trading securities:

Auction rate securities — UBS — student loan backed . . — 50,589

Auction rate securities — UBS — municipal authority

bonds . ................................... — 11,959

Total trading securities........................ — 62,548

Available-for-sale securities:

Auction rate securities — student loan backed ........ 118,390 139,239

Auction rate securities — municipal authority bonds.... 23,404 27,294

Total available-for-sale securities ................ 141,794 166,533

Total non-current marketable securities............ 141,794 229,081

Rabbi Trust assets:(1)

Money market funds ............................. 1,316 473

Municipal notes and bonds ........................ 18,537 18,804

Trust-owned life insurance policies (at cash surrender

value) . . . ................................... 51,391 32,549

Total Rabbi Trust assets ........................ 71,244 51,826

Total cash and equivalents and investments .......... $925,507 $803,029

(1) Rabbi Trust assets are included in Other Assets on the Consolidated Balance Sheets and are restricted as

to their use.

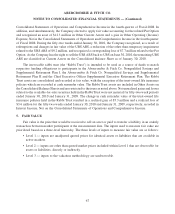

At January 30, 2010 and January 31, 2009, the Company’s marketable securities consisted of investment

grade auction rate securities (“ARS”) invested in insured student loan backed securities and insured municipal

authority bonds, with maturities ranging from 17 to 33 years. Each investment in student loans is insured by

65

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)